peshkov

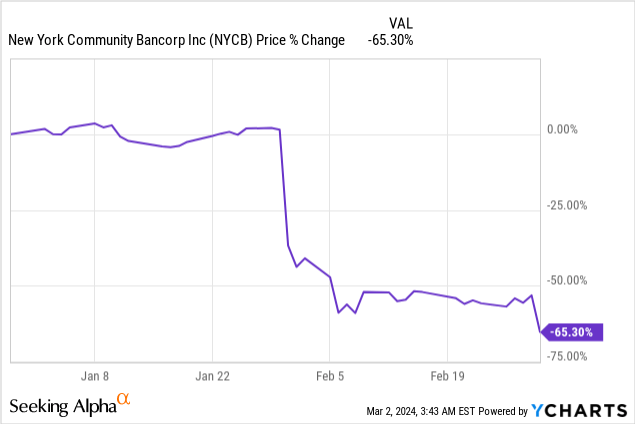

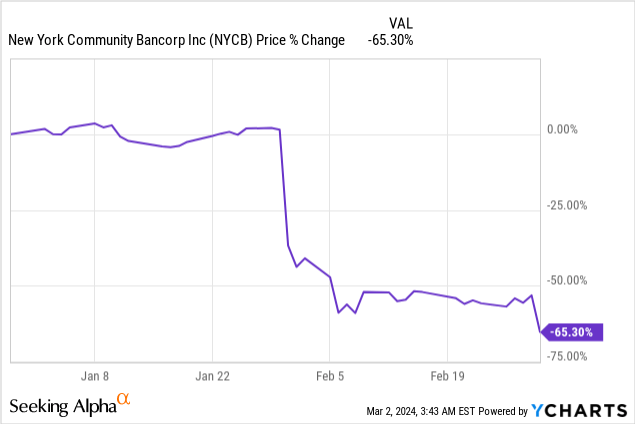

New York Group Bancorp (NYSE:NYCB) made a few vital filings with the Securities and Trade Fee final week that precipitated the regional financial institution’s share worth to tank by as much as 30%. The financial institution introduced that it could delay the submission of its 10-Okay report as a result of an recognized materials weak spot in regard to New York Group Financial institution’s inner controls and disclosed a $2.4B goodwill impairment that may decrease This autumn and FY 2023 earnings. These developments come after New York Group grappled with a deterioration of investor sentiment in January by disclosing an enormous leap in mortgage loss provisions associated to its CRE mortgage portfolio. New York Group Financial institution additionally introduced that the financial institution’s Chief Government Officer resigned. I’m giving my tackle the evolving scenario and explaining why I’m shopping for extra shares!

Earlier score

I lined New York Group Financial institution for the primary time in January — Why I Am Buying The 70% Dividend Cut — when the financial institution’s share worth crashed after the lender reported hovering credit score provisions associated to its CRE mortgage portfolio in This autumn’23. Because of this, New York Group Financial institution introduced a 70% dividend lower. The present occasions surrounding further materials disclosures have resulted in one more sell-off, pushing the share worth of the financial institution to the bottom degree since 1996. I imagine buyers could also be overreacting to final week’s information. Whereas dropping the CEO and materials weaknesses in inner controls are not any cause to deliver out the champagne, shares of NYCB commerce at an enormous low cost to even the decrease ebook worth.

Goodwill impairment, earnings restatement, delay in 10-Okay, CEO alternative

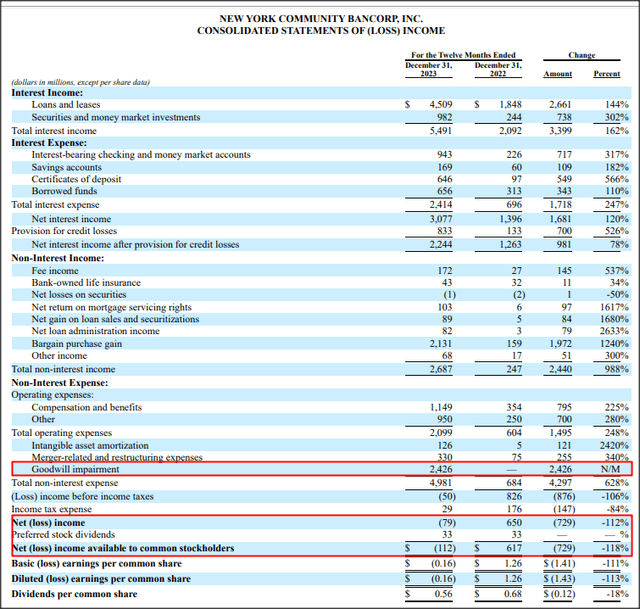

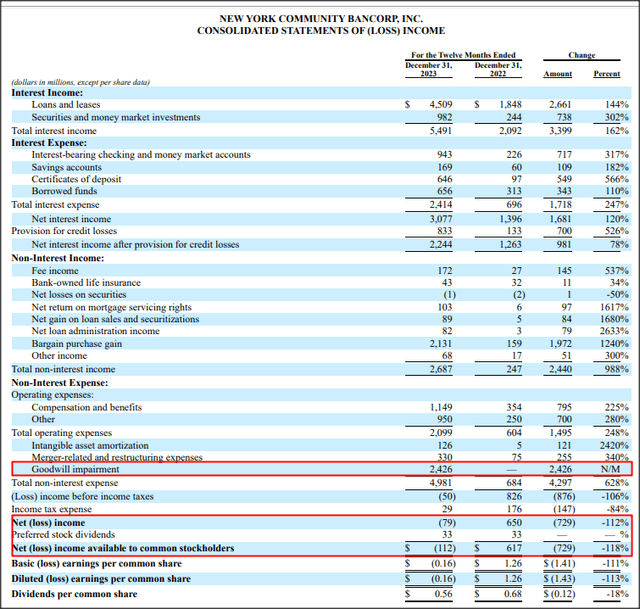

New York Group Financial institution made an 8K-disclosure (Source) on February 29, 2024 which said that the financial institution will decrease its fourth-quarter and FY 2023 earnings by $2.4B associated to a goodwill impairment cost (which affected transactions made solely in 2007 and earlier). The $2.4B cost lowers the goodwill quantity on the financial institution’s steadiness sheet however would not have an effect on the financial institution’s regulatory capital. Since New York Group Financial institution had $2.34B in web revenue in FY 2023 (reported in January 2024), the goodwill-related earnings restatement totally wipes out the financial institution’s full-year revenue.

SEC Submitting NYCB – Exhibit 99.1

Moreover, the financial institution introduced (Source) that administration recognized materials weaknesses in its inner controls, which led to the delay within the submission of the 10-Okay annual report. The disclosure learn:

As a part of administration’s evaluation of the Firm’s inner controls, administration recognized materials weaknesses within the Firm’s inner controls associated to inner mortgage evaluate, ensuing from ineffective oversight, threat evaluation and monitoring actions. Though evaluation of the Firm’s inner controls is just not but full, the Firm expects to reveal within the 2023 Type 10-Okay that its disclosure controls and procedures and inner management over monetary reporting weren’t efficient as of December 31, 2023.

The financial institution additionally mentioned in one more separate submitting (Source) that Mr. Thomas R. Cangemi was resigning as President and Chief Government Officer and that he has been changed by Mr. Alessandro DiNello, beforehand Government Chairman of the Board. Whereas a CEO alternative, particularly within the midst of a disaster, is clearly not excellent news for shareholders, buyers ought to quickly return to deal with the financial institution’s fundamentals once more.

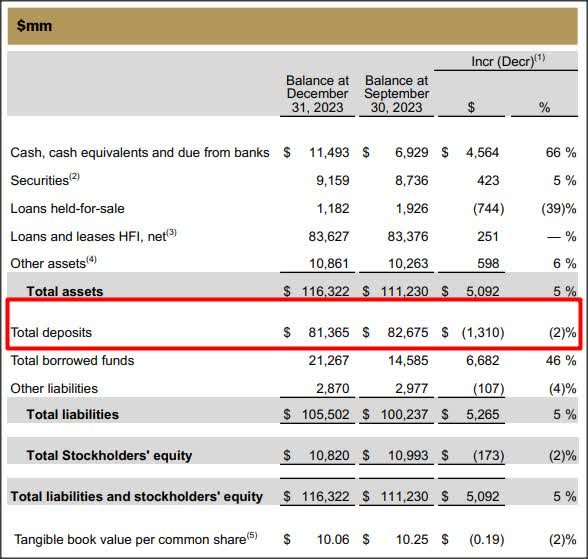

As I mentioned final time, I count on New York Group Bancorp to promote extra belongings, particularly workplace loans, with a purpose to enhance its liquidity and shrink its CRE mortgage portfolio. Whereas the 8-Okay disclosure triggered a minor meltdown on Friday, my expectation is for buyers to return their focus to the financial institution’s nonetheless appreciable ebook worth and better security margin that’s now embedded within the financial institution’s valuation. On the identical time, I imagine the financial institution’s $8.4B in fairness and sizable (principally insured) deposit base present a cushion in opposition to additional losses.

Sturdy deposit base, excessive share of insured deposits restrict dangers of a deposit run

Traders began to panic once more on Friday as they digested the developments at NYCB. Apart from a brand new injection of contemporary uncertainty and issues in regards to the financial institution’s monetary state, there may be now a threat that the financial institution’s clients could fear about their deposits, particularly if issues over the financial institution’s stability and solvency unfold within the close to time period.

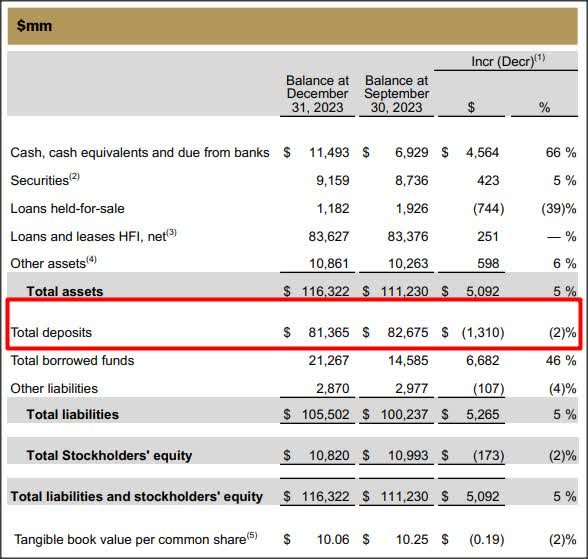

New York Group Financial institution had $81.4B in deposits on its steadiness sheet as of December 31, 2023 and deposits marginally declined, by 2%, within the fourth-quarter.

New York Group Financial institution

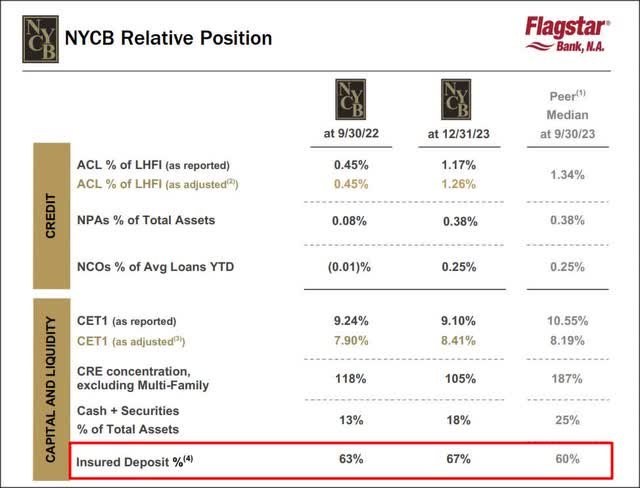

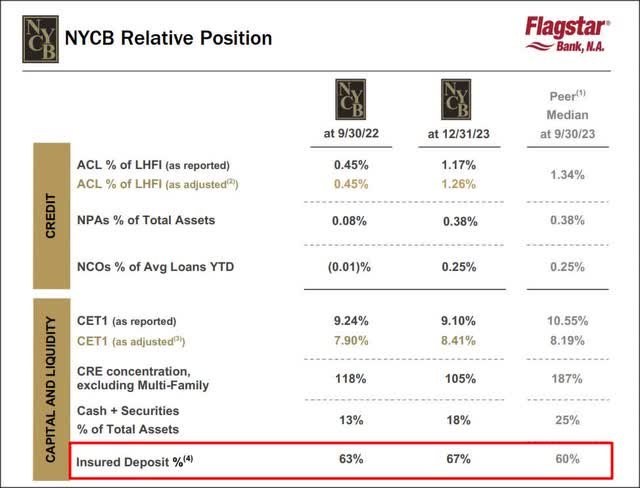

I’m not very fearful a couple of potential deposit run following the financial institution’s disclosures on Thursday, nevertheless, largely as a result of the Federal Reserve stepped in aggressively through the regional banking disaster in 2023 and made emergency liquidity accessible to the sector quick. So, there may be undoubtedly some Federal Reserve assist accessible ought to the financial institution want extra liquidity within the brief time period. Secondly, New York Group Financial institution had a excessive share of insured deposits on its steadiness: 67% as of the top of FY 2023 which drastically reduces the probability of a deposit run, in my view.

New York Group Financial institution

Enormous security margin

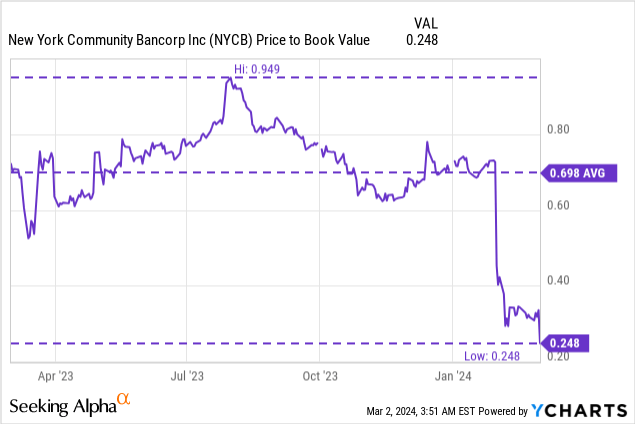

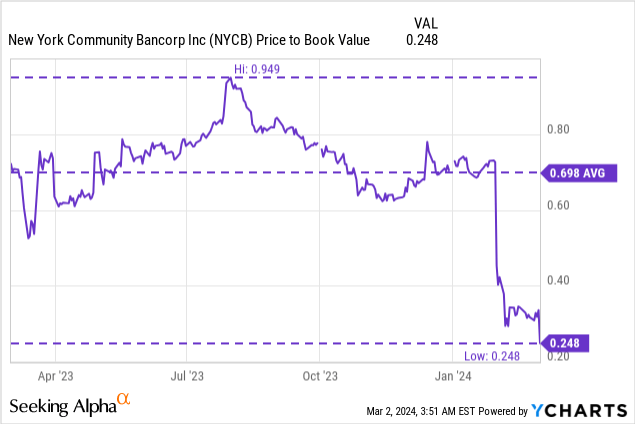

I imagine New York Group Financial institution is finest valued based mostly off of ebook worth on condition that its earnings, no less than briefly could also be affected by increased credit score provisions (which I mentioned in my final work on NYCB). Final time I lined New York Group Financial institution, I utilized a threat low cost of 30% to the regional financial institution’s ebook worth due to its business actual property publicity.

The $2.4B hit to earnings ought to decrease the financial institution’s ebook worth by ~$3.40 per-share (calculated as $2.42B in new goodwill impairment divided by 722.4M excellent shares). New York Group Financial institution’s ebook worth was $14.28 per-share as of December 31, 2023. Lowering this year-end ebook worth by $3.40 per-share associated to the goodwill affect ought to lead to a post-impairment ebook worth of $10.88 per-share. My estimate for risk-adjusted ebook worth (making use of a 30% low cost to BV to account for CRE dangers) could be $7.62 per-share. That is the value that I imagine fairly constitutes truthful worth now.

Shares of NYCB commerce considerably beneath the 1-year common P/B ratio, reflecting big investor issues in regards to the regional financial institution proper now. Shares now commerce at a 75% low cost to the final reported ebook worth, at a 67% low cost to the post-impairment ebook worth and at a 53% low cost to my risk-adjusted truthful worth estimate. The valuation right here contains an enormous security margin, which is why I doubled my place on Friday at a mean worth of $3.66 per-share.

Dangers with NYCB

Within the brief time period, there are appreciable sentiment dangers for New York Group Financial institution. There are additionally dangers associated to how depositors are going to answer the earnings restatement information. The largest business threat, as I see it, possible pertains to the corporate’s CRE mortgage publicity, which I mentioned in my final work from January. This view has not modified, and I proceed to use a threat low cost to the financial institution’s ebook worth with a purpose to account for these dangers. Going ahead, I’ll take note of the financial institution’s provision development, deposit flows (large deposit outflows could be a warning signal) in addition to ebook worth per-share progress.

Ultimate ideas

That was a number of unhealthy information to digest final week, however the market possible overreacted on Friday, because it tends to do when a financial institution publicizes an earnings restatement and loses its CEO. Nevertheless, the financial institution already has a CEO alternative and the non-cash goodwill impairments had been solely associated to transactions from 2007 or earlier. Whereas the financial institution made a bigger loss, which reduces ebook worth, buyers can nonetheless profit from an enormous security margin embedded in New York Group Financial institution’s valuation. A excessive share of insured deposits must also decrease any dangers of deposit withdrawals. I’ve doubled my place on Friday and could be ready so as to add incrementally if shares proceed to slip. My funding in NYCB, nevertheless, solely accounts for 1.3% of my investable belongings, so I can afford to take some threat right here!