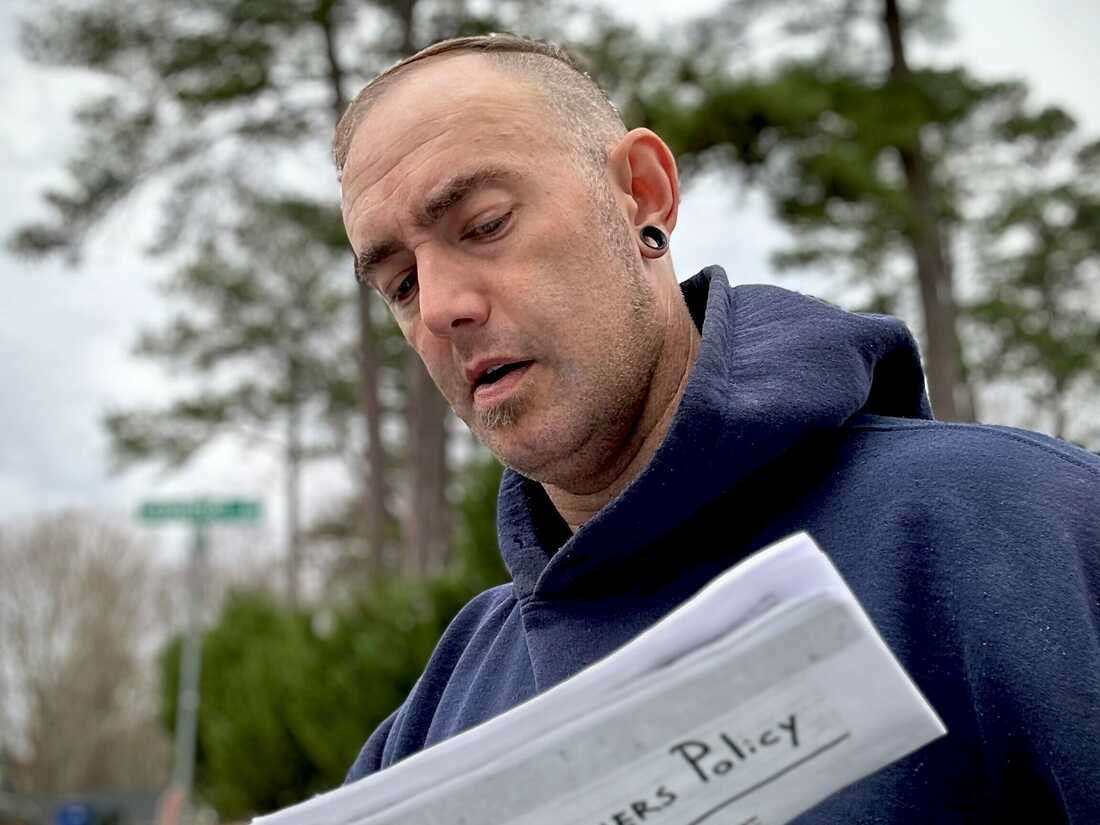

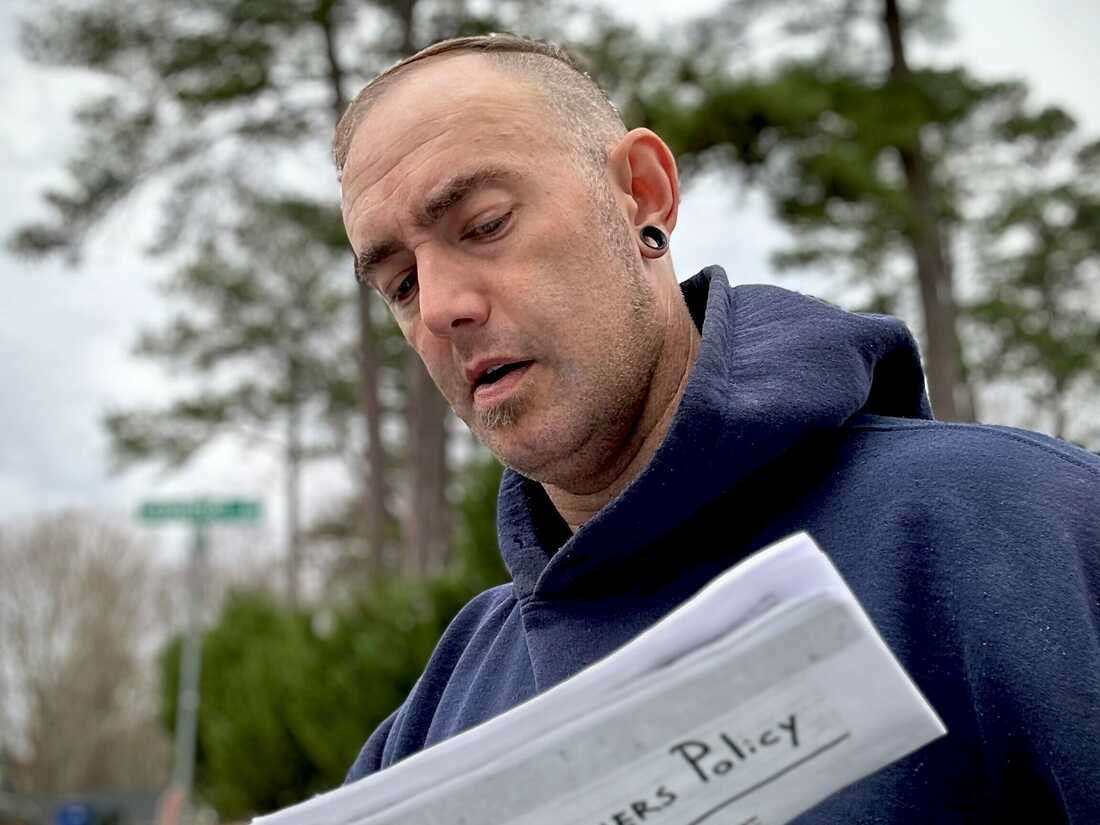

Ezra Croft from North Carolina noticed his annual householders’ insurance coverage surge to $1,600, a $700 improve. Many others throughout the nation are additionally seeing surging auto and residential insurance coverage premiums. Courtesy of Ezra Croft conceal caption

Ezra Croft from North Carolina noticed his annual householders’ insurance coverage surge to $1,600, a $700 improve. Many others throughout the nation are additionally seeing surging auto and residential insurance coverage premiums.

Courtesy of Ezra CroftEzra Croft has by no means filed an insurance coverage declare, and his home in Raleigh, North Carolina is not near a stormy shoreline or a fire-prone forest.

So Croft was stunned when his annual home-owner’s insurance coverage premium shot as much as $1,600, or $700 {dollars} greater than he was paying simply a few years in the past.

“I am a center earnings man,” Croft says. “Do not make a ton of additional cash. At this level I am teetering on the purpose of inaffordability.”

Related complaints will be heard everywhere in the nation. On common, insurance coverage firms sought to boost householders’ premiums by greater than 11% final yr, in accordance with S&P Global Market Intelligence.

Auto insurance coverage premiums are climbing even faster, far outpacing overall inflation.

Take Paul Morro. His auto insurance coverage invoice simply jumped by $600 a yr.

“Here is the kicker,” Morro says. “My spouse and I each earn a living from home. So now we have no commute to talk of.”

He is bracing himself for the invoice to insure his home, in Herndon, Va.

“It simply looks like the whole lot is rising at a scary price,” Morro says.

Why insurance coverage prices are surging

Insurance coverage firms insist they’re simply taking part in catch-up, after two years of huge losses. For each greenback in house and auto premiums they collected final yr, insurance coverage firms paid a mean of $1.10 in claims and bills, in accordance with the Insurance coverage Data Institute.

“No person desires to have that higher-price invoice,” says Sean Kevelighan, the institute’s CEO. However he added firms “want to cost insurance coverage in accordance with the chance stage that is on the market.”

Inflation is partly in charge for these huge payouts. The price of fixing or changing broken properties and automobiles has jumped sharply lately because of rising labor and materials costs.

At the same time as these costs begin to stage off, although, insurers are having to deal with a mounting toll of pure disasters, and never simply within the normal locations like Florida and California.

A automotive stays within the wreckage after a home and storage had been abruptly destroyed by a landslide as an atmospheric river storm inundates the Hollywood Hills space of Los Angeles on Feb. 6, 2024. A spate of pure disasters helps result in hovering insurance coverage premiums throughout the nation. David McNew/AFP by way of Getty Photos conceal caption

A automotive stays within the wreckage after a home and storage had been abruptly destroyed by a landslide as an atmospheric river storm inundates the Hollywood Hills space of Los Angeles on Feb. 6, 2024. A spate of pure disasters helps result in hovering insurance coverage premiums throughout the nation.

David McNew/AFP by way of Getty PhotosFinal yr, there have been around two dozen severe storms in the U.S. with billion-dollar value tags, spreading lightning, hail and damaging winds by means of many components of the nation.

“Whereas loads of these storms do not make nationwide headlines, they do are usually very pricey on the native stage,” says Tim Zawacki, principal analysis analyst for insurance coverage at S&P International Market Intelligence. “And the breadth of the place these storms are occurring is one thing that I believe the business is kind of involved about.”

In consequence, insurance coverage premiums are prone to maintain climbing this yr whilst general inflation cools.

Insurers have loads of pricing energy

Whereas state regulators have some energy to restrict these value hikes, insurance coverage firms are inclined to get their method. Regulators know that in the event that they transfer too aggressively to restrict premiums, insurance coverage firms would possibly cease providing protection altogether.

“The insurance coverage firms have grow to be actually aggressive of their bullying,” says Doug Heller, director of insurance coverage for the Client Federation of America. “You’ve got heard lots about firms which can be threatening to drag out of the market if they do not get what they need. Usually talking that bullying has labored.”

Douglas Heller, director Of insurance coverage on the Client Federation of America, speaks throughout a Senate Banking Committee listening to concerning the property insurance coverage market on Capitol Hill in Washington, D.C., on Sept. 7, 2023. Anna Moneymaker/Getty Photos conceal caption

Douglas Heller, director Of insurance coverage on the Client Federation of America, speaks throughout a Senate Banking Committee listening to concerning the property insurance coverage market on Capitol Hill in Washington, D.C., on Sept. 7, 2023.

Anna Moneymaker/Getty PhotosFinal week, the Treasury Division hosted a roundtable with client and environmental teams to debate the methods local weather change is rattling insurance coverage markets. The division additionally plans to host a gathering on the subject with insurance coverage business stakeholders.

Prospects can generally get monetary savings by procuring round. Alicia Pitorri switched insurance coverage carriers after the price of her household’s auto coverage jumped greater than a thousand {dollars}.

“It was Liberty Mutual,” she says with a rueful snigger. “We have since switched to State Farm because the renewal went up a lot.”

Pitorri, who lives in Nashville, says whereas she managed to shave a couple of hundred {dollars} off the invoice, she’s nonetheless paying much more than she did two years in the past.

“What are you able to do?” she asks. “You want insurance coverage. You’ll be able to’t have a car or a home with out them. So it’s a must to pay for it. And you determine the place you possibly can lower different issues to be sure you can drive round.”

Going with out insurance coverage

Auto insurance coverage is required in almost all states. And lenders sometimes require householders who’ve a mortgage to hold insurance coverage as properly. Nonetheless, as premiums maintain climbing, extra persons are scaling again their protection and even going with out.

Ezra Croft thought of dropping his householders’ protection, however finally determined to pay the upper premium.

“I am pretty good at house repairs, but when one thing like a tree fell on my home or a twister or a fireplace, I do not know what I might do,” Croft says.

A survey by the Insurance coverage Data Institute final yr discovered 12% of house owners had no insurance coverage, up from 5% 4 years earlier. Going with out protection is dangerous, although, for each people and communities.

“Insurance coverage is a crucial product, not just for financial stability however for group resilience,” says Heller. “We’re very involved that these escalating premiums are going to result in escalating charges of uninsured drivers and householders, which makes us all fairly weak.”