Bitcoin (BTC) has commenced March on a excessive observe, establishing its value above the $60,000 support zone and attaining the very best month-to-month shut since October 2021, moments earlier than it reached an all-time excessive.

Certainly, the present constructive momentum is supported by a number of bullish parts, together with the upcoming halving and the continuing efficiency of exchange-traded funds (ETF). Consistent with this, a big market consensus means that the rally will seemingly proceed its upward pattern.

Commenting on what to anticipate from Bitcoin, crypto buying and selling professional Buying and selling Shot, in a TradingView post on March 2, highlighted that, based mostly on technical indicators and historic patterns, Bitcoin is poised to achieve a brand new all-time excessive earlier than the subsequent halving.

With Bitcoin having damaged the 0.382 Fibonacci level on the weekly chart in early February for the primary time since June 6, 2022, the professional noticed that the event is essential in cyclical phrases, drawing parallels with earlier cycles.

Making use of the Fibonacci Channel to the final two cycles, Buying and selling Shot identified that each time Bitcoin surpassed the 0.382 Fibonacci degree up to now cycle, it additionally hit the 0.5 Fib degree. This statement holds significance because it has occurred twice earlier than.

Notably, the time it took for Bitcoin to achieve the 0.5 Fib degree after breaking the 0.382 Fib degree in these situations was seven weeks (49 days) and eight weeks (56 days).

Primarily based on this historic sample, the analyst estimated a most of eight weeks for Bitcoin to hit the 0.5 Fib degree once more. If this sample repeats precisely, the goal week can be April 1, 2024. In such a situation, Bitcoin might attain $81,000. Nevertheless, if the breakthrough occurs earlier, the vary might be between $78,000 and $81,000.

Market prepared for parabolic rally

On the similar time, amid prevailing bullish sentiments dominating the market, Buying and selling Shot steered that the cryptocurrency market could also be coming into probably the most aggressive part of the present cycle.

“The 1W CCI indicator (inexperienced circles) means that we could be nearer to a November 2020 fractal than Could – June 2019 (which was in fact brought on by the Libra euphoria). This means that at present we could be on the very begin of this Cycle’s most aggressive half, the Parabolic Rally,” he stated.

Notably, Bitcoin’s present value has coincided with what seems to be important demand for the product’s ETF, with investors more and more betting on BTC to reclaim the $69,000 file excessive. As of March 1, the cumulative spot Bitcoin ETF quantity reached an all-time excessive of $73.91 billion after weeks of constant features.

The potential influence of the ETF briefly propelled Bitcoin to the touch $64,000 earlier than retracing barely under the $62,000 spot.

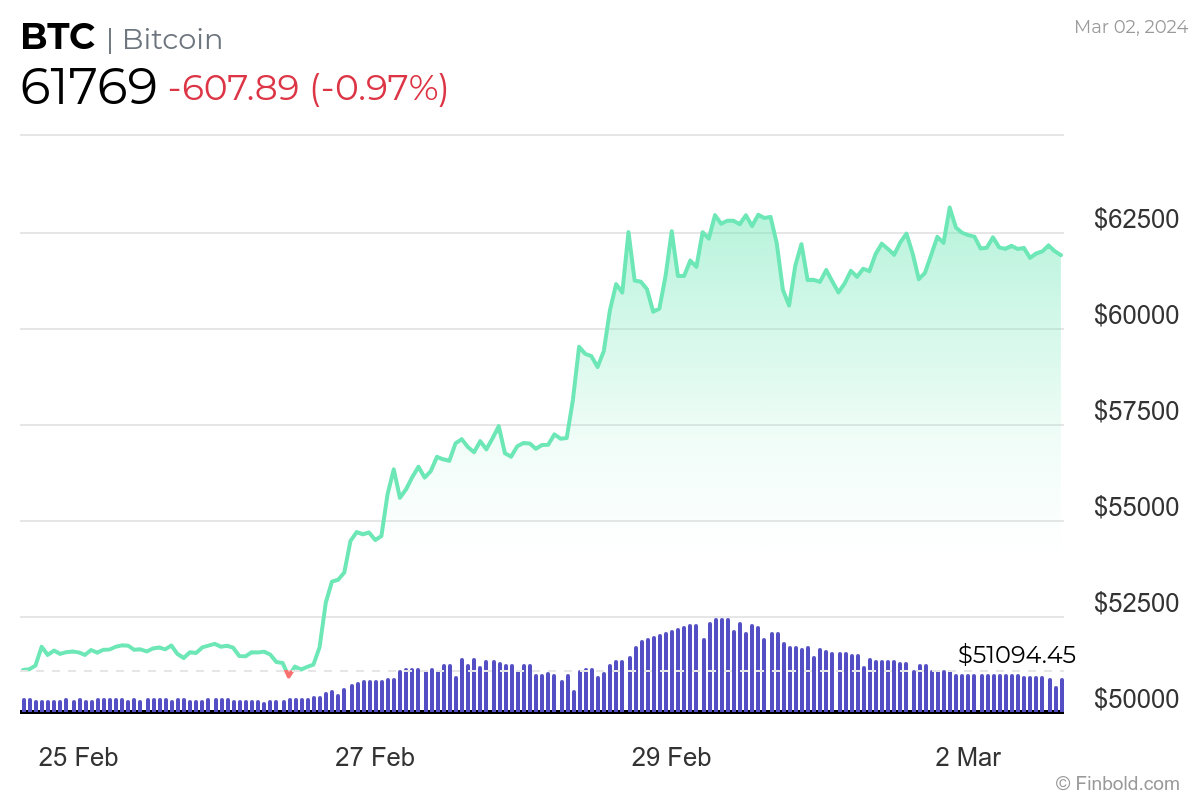

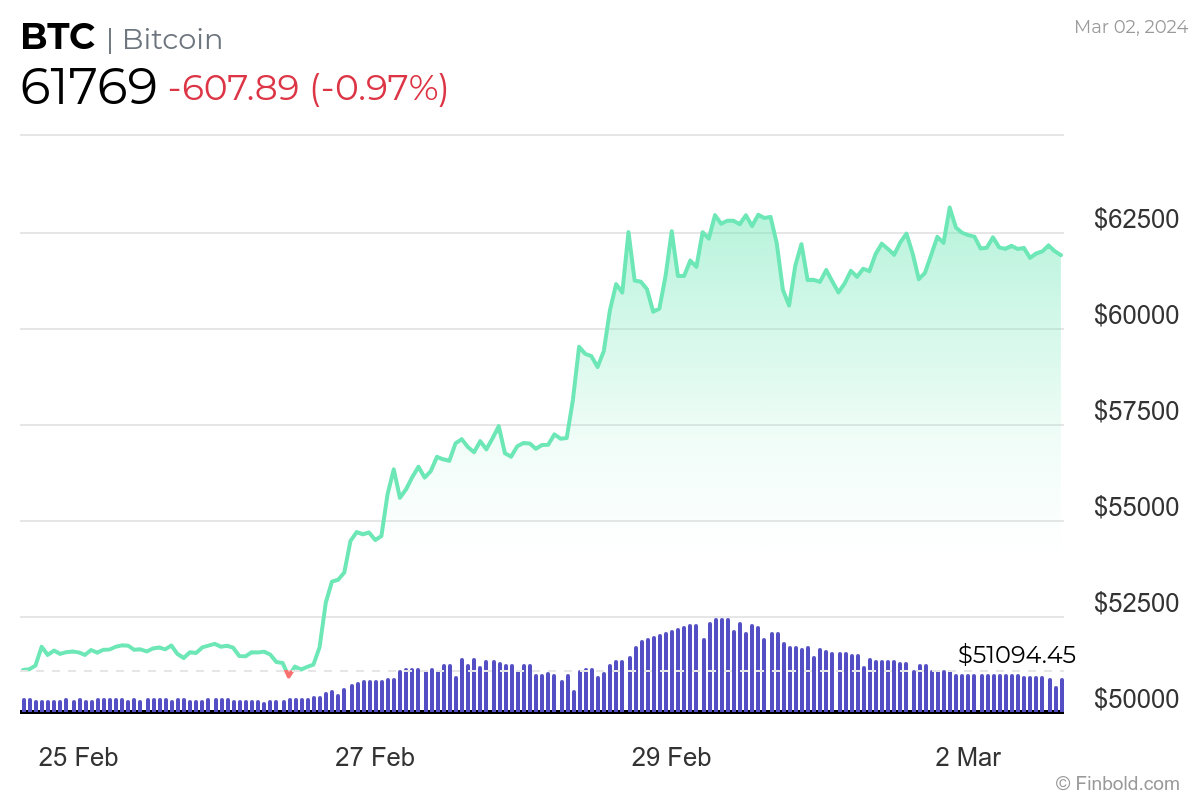

Bitcoin value evaluation

By press time, Bitcoin is valued at $61,769 with day by day features of virtually 1%. Over the previous seven days, Bitcoin has rallied 20%.

Regardless of the bulk consensus pointing in direction of sustained Bitcoin features, warning is warranted, because the asset will seemingly expertise a correction, particularly within the occasion of elevated profit-taking.

Disclaimer: The content material on this website shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.