Shopping for and holding nice corporations for the long term is a tried-and-tested method of earning money within the inventory market, as traders can’t solely profit from secular progress alternatives by following this philosophy but in addition reap the benefits of the facility of compounding.

Artificial intelligence (AI) has emerged as the subsequent huge progress alternative for traders. Bloomberg estimates that the generative AI market, which was value $40 billion in 2022, might generate a whopping $1.3 trillion of annual income in 2032. The AI market is ready to clock a compound annual progress fee of 42% throughout this era.

As such, now can be a very good time for traders to spend money on corporations that would acquire loads from this profitable alternative in the long term. Shopping for AI shares as part of a diversified portfolio might even assist traders turn out to be millionaires. As an illustration, a $10,000 funding made in Nvidia — a pioneer in AI {hardware} — a decade in the past is now value $1.68 million.

In fact, anticipating different AI shares to duplicate Nvidia’s gorgeous positive aspects is not logical. Nonetheless, shopping for shares of Taiwan Semiconductor Manufacturing (TSM 4.07%), popularly generally known as TSMC, and Tremendous Micro Laptop (SMCI 4.54%) with $10,000 in investible money may very well be a wise long-term transfer.

Assuming you’ve got $10,000 at your disposal after settling your payments, clearing costly debt, and having saved sufficient for an emergency fund, placing that cash into TSMC and Tremendous Micro might enable you assemble a million-dollar portfolio. Let’s examine why.

1. Taiwan Semiconductor Manufacturing

The demand for semiconductors is booming because of AI. The worldwide semiconductor market generated $315 billion in income in 2013, in response to Gartner, a quantity that elevated to $533 billion final yr. So the worldwide semiconductor market added $218 billion in income in the course of the previous decade. AI is ready to drive a lot stronger progress for the worldwide semiconductor market over the subsequent decade.

Allied Market Analysis estimates that AI chip income might hit practically $384 billion a yr in 2032, posting a CAGR of 38%. TSMC offers traders a strong approach to capitalize on this enormous end-market alternative. That is as a result of the Taiwan-based firm is the world’s main foundry, with an estimated market share of 58%, in response to TrendForce. It enjoys an enormous lead over second-place Samsung, which has a market share of simply over 12%.

The foundry business model means TSMC manufactures chips for different corporations. Its clients embody Apple, Nvidia, Broadcom, and Superior Micro Gadgets, amongst others. The massive surge within the demand for AI chips has started driving solid growth for TSMC. Gross sales of the corporate’s superior chips made on a 5-nanometer (nm) course of node have gained spectacular traction in current quarters.

What’s extra, TSMC is now anticipating its 3nm course of node, which can be deployed to make more powerful AI chips, to contribute $12.7 billion in income this yr.

In December 2022, TSMC administration stated that its 3nm course of node can be utilized by chipmakers to make finish merchandise value $1.5 trillion inside 5 years of beginning quantity manufacturing. Now that this course of node is gaining traction and anticipated to account for 15% of TSMC’s income this yr, it appears set to maneuver the needle in a much bigger method for the corporate.

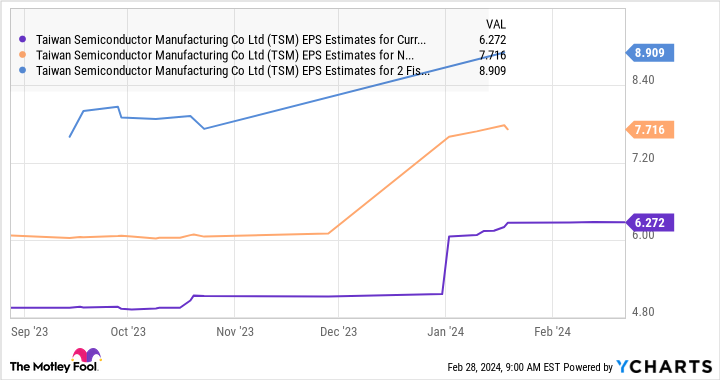

Not surprisingly, analysts are anticipating TSMC’s bottom-line progress to leap considerably in comparison with final yr’s studying of $5.18 per share.

TSM EPS Estimates for Current Fiscal Year knowledge by YCharts

If TSMC is ready to obtain $8.90 per share in earnings in 2026 and trades at 31 instances forward earnings at the moment (utilizing the Nasdaq-100‘s ahead earnings a number of as a proxy for tech shares), its share worth might bounce to $276. That factors towards a 115% bounce in three years, suggesting that TSMC might greater than double traders’ cash.

However if you happen to can proceed to carry the inventory for a for much longer time, to illustrate 10 or 15 years, it might ship rather more upside and contribute properly to a million-dollar portfolio.

2. Tremendous Micro Laptop

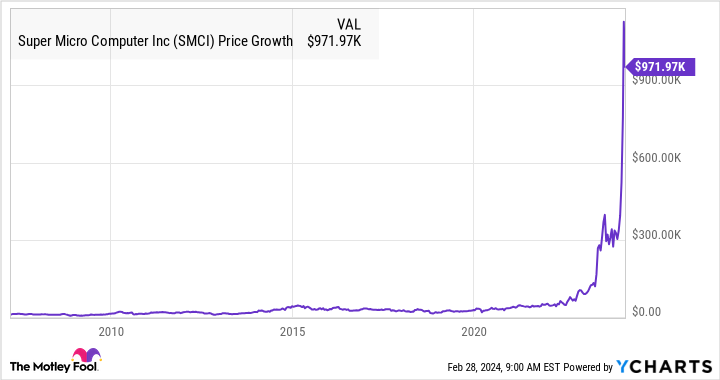

Tremendous Micro Laptop went public in 2007, and a $10,000 funding within the inventory throughout its preliminary public providing (IPO) is now value greater than $970,000.

The inventory tripled in 2024 as AI has supercharged its progress. The corporate is anticipating to complete its present fiscal yr with income of $14.5 billion, an enormous bounce in comparison with the $7.1 billion income it generated within the previous fiscal yr. Tremendous Micro’s progress took off as its server options had been being deployed for mounting AI chips. The excellent news is that Tremendous Micro’s end-market alternative is ready to increase considerably in the long term.

In line with a third-party estimate, the worldwide AI server market might generate $177 billion in annual income in 2032, up from $38 billion final yr. Tremendous Micro’s full-year income forecast for fiscal 2024 means that it’s at first of a terrific progress curve, particularly contemplating that it’s anticipated to nook a much bigger share of this market.

In line with Barclays, the corporate was sitting on a 7% share of the general server market final yr. Nonetheless, its efforts to bump its manufacturing capacity are anticipated to assist it take share away from rivals. As such, it’s straightforward to see why analysts are forecasting a 48% annual bounce within the firm’s earnings for the subsequent 5 years.

Primarily based on its fiscal 2023 earnings of $11.81 per share, Tremendous Micro’s backside line might enhance to virtually $84 per share after 5 years. Multiplying the projected earnings with the Nasdaq-100’s ahead earnings a number of of 31 might ship its inventory worth to $2,600. That will be triple its present inventory worth.

In fact, the long-term alternative in AI servers implies that Tremendous Micro might ship even greater positive aspects over the subsequent decade, which is why traders trying to construct a million-dollar portfolio would do effectively to purchase this AI inventory with their investible money.

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Barclays Plc, Broadcom, Gartner, and Tremendous Micro Laptop. The Motley Idiot has a disclosure policy.