To say PayPal’s (NASDAQ: PYPL) inventory has struggled over the previous three years is a little bit of an understatement. Heading into 2024, the inventory noticed adverse returns the previous three years, and it was down practically -75% throughout that interval.

Trying to spark curiosity within the inventory, new CEO Alex Chriss acknowledged throughout a CNBC interview that PayPal would “shock the world” at an Innovation occasion it was holding in late January.

The occasion did not precisely depart buyers in awe, nonetheless, because the occasion centered on PayPal’s Artificial Intelligence (AI) ambitions. In 2024, enhancing merchandise by AI is not precisely leading edge. In the meantime, the inventory bought off a pair weeks later after the corporate reported its This autumn outcomes.

The query now turns into: can buyers go cut price searching on this beaten-up identify?

Overpromising and underdelivering

The narrative with PayPal the previous couple of years has been that it is a fading enterprise going through aggressive pressures. And make no mistake, these are the most important dangers the corporate faces.

Nonetheless, the corporate’s numbers do not essentially mirror this narrative. Key metrics for the corporate have constantly grown over the previous three years regardless of the precipitous fall in its share worth.

Whole fee quantity, which is the sum of money that flows by its fee processing system, has risen every quarter over the previous few years, and progress on this metric accelerated in 2023. Variety of fee transactions has additionally solidly grown, as has income. Now every little thing hasn’t been excellent, as the corporate has seen its variety of energetic accounts cease rising.

Extra lately, PayPal got here beneath strain resulting from its 2024 steerage. The corporate forecast Q1 income progress of 6.5%, however did not situation full-year income steerage, whereas it mentioned it anticipated adjusted EPS to be in step with the $5.10 it reported in 2023.

So why did not buyers like this? As a result of analysts had been on the lookout for 2024 adjusted EPS of $5.53. Inventory efficiency is commonly tied to future projections and the way corporations carry out versus expectations, so when an organization forecasts earnings under analyst expectations, the inventory falls.

Innovation to paved the way

Now whereas PayPal did not shock the world at its Innovation occasion, it did introduce some promising AI-powered choices. One space of focus for the corporate is dashing up the checkout course of and eradicating friction for shoppers. On this finish, the corporate launched two new choices: PayPal Checkout and Fastlane. The previous replaces having to kind in passwords with biometrics, similar to face and fingerprint recognition, whereas the latter permits for one-tap purchases.

Growing buyer engagement and personalization are two different areas that PayPal is focusing on. With its Sensible Receipts providing, PayPal will present prospects a receipt in addition to personalised product suggestions from the identical service provider.

Alongside the identical strains, the PayPal superior provides platform will analyze transaction information through AI to ship personalised provides to prospects. That is largely an promoting instrument, and retailers solely pay when a buyer buys the advisable product. In the meantime, with PayPal CashPass, shoppers will be capable to earn money again on purchases in addition to rewards.

None of those improvements by themselves are precisely groundbreaking. Nonetheless, they’re strong choices that ought to assist drive engagement and transactions progress.

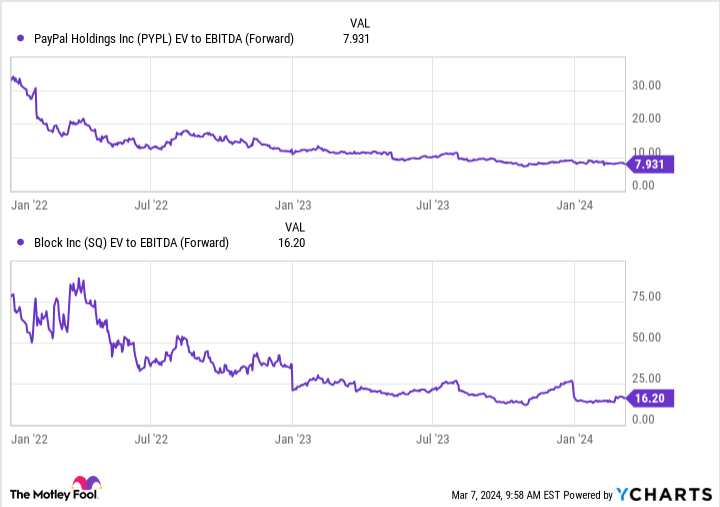

With the autumn of its inventory worth over the previous few years, PayPal’s valuation has tremendously shrunk. It additionally trades at about half the EV/EBITDA a number of as rival and fellow fee processing firm Block (NYSE: SQ). Given PayPal’s robust money place, I choose utilizing this widespread valuation metric, as Enterprise Value (EV) takes into consideration an organization’s stability sheet, whereas EBITDA removes the influence of any non-cash impacts.

PYPL EV to EBITDA (Forward) information by YCharts

Given its low-cost historic and relative valuation, what buyers have to see from the corporate is innovation and progress. Whereas these new choices did not shock the world, they do appear to be they need to present precisely that.

What about PayPal’s disappointing steerage?

Forward on its Innovation occasion, CEO Chriss overpromised and undelivered, which isn’t a very good factor for shares, as buyers are at all times on the lookout for corporations to exceed expectations. In the meantime, a number of weeks later, administration provided up some fairly tepid steerage for 2024.

Whereas which will appear unhealthy, there’s a good chance that Chriss shortly realized his lesson and when the corporate issued its 2024 steerage, the plan was to underpromise and overdeliver. Given all the brand new promising choices that PayPal is ready to introduce, steerage seems to be conservative.

Probably the greatest setups for shares is an inexpensive valuation and low expectations. If PayPal can surpass what appears like a low bar, 2024 may very well be the beginning of a turnaround for the inventory.

The place to take a position $1,000 proper now

When our analyst crew has a inventory tip, it could pay to hear. In any case, the e-newsletter they’ve run for 20 years, Motley Idiot Inventory Advisor, has greater than tripled the market.*

They only revealed what they imagine are the 10 best stocks for buyers to purchase proper now… and PayPal made the record — however there are 9 different shares chances are you’ll be overlooking.

*Inventory Advisor returns as of March 8, 2024

Geoffrey Seiler has positions in Block. The Motley Idiot has positions in and recommends Block and PayPal. The Motley Idiot recommends the next choices: brief March 2024 $67.50 calls on PayPal. The Motley Idiot has a disclosure policy.

PayPal Didn’t Shock the World. What’s Next for Investors? was initially printed by The Motley Idiot