[ad_1]

Whether or not you are an informal investor or commerce professionally, you are doubtless conscious of the increase in synthetic intelligence (AI) that kicked off final yr. The launch of OpenAI’s ChatGPT reignited curiosity within the know-how, main numerous tech corporations to pivot their companies towards the high-growth sector.

In consequence, the AI market is projected to develop at a compound annual development fee of 37% by 2030, which is able to see it hit just below $2 trillion. The trade is increasing at a fast tempo, making it among the best locations to make a long-term funding.

Two shares at present main the way in which in AI are Superior Micro Units (NASDAQ: AMD) and Nvidia (NASDAQ: NVDA), with their shares lately up 149% and 257% respectively yr over yr. As outstanding chipmakers, these corporations provide the {hardware} needed to coach and run AI fashions. Their shares may soar additional within the coming years because the market develops.

So, let’s examine these corporations’ companies and decide whether or not AMD or Nvidia is the higher AI inventory this March.

Superior Micro Units

AMD was barely overshadowed by Nvidia’s head begin in AI chips final yr, as Nvidia seized an estimated 80% to 95% market share in AI graphics processing units (GPUs).

Nevertheless, the large potential of the trade suggests AMD will not must dethrone Nvidia to nonetheless see main positive factors from AI. So, regardless of spending years prioritizing its place in central processing items (CPUs), AMD has shifted its focus to growing its GPU know-how and increasing within the budding AI market.

Final December, the corporate unveiled its MI300X AI GPU. The chip was designed to compete instantly with Nvidia’s choices and has already caught the eye of a few of tech’s most outstanding gamers.

In November 2023, Microsoft introduced that Azure would turn into the primary cloud platform to make use of AMD’s MI300X to optimize AI capabilities. Microsoft has a detailed partnership with ChatGPT developer OpenAI, making the corporate a robust ally for AMD. An settlement with Meta — which goals to make use of the brand new chips as nicely — additionally helps AMD’s future in AI look vivid.

Furthermore, AMD is not banking solely on stealing market share from Nvidia in GPUs. AMD seeks to steer its personal house inside AI by investing in AI-powered PCs. In line with analysis agency IDC, PC shipments are projected to see a significant increase this yr, with AI integration serving as a key catalyst. And a Canalys report predicts that 60% of all PCs shipped in 2027 will probably be AI-enabled.

Nvidia

Nvidia captivated Wall Avenue during the last yr as its chips grew to become the gold normal for AI builders all over the place.

Hovering demand for AI GPUs enabled Nvidia’s income to skyrocket. Within the fourth quarter of 2024 (led to January), the corporate’s income elevated by 265% yr over yr to $22 billion. In the meantime, working earnings jumped 983% to just about $14 billion. The monster development was primarily from a 409% improve in knowledge heart income, reflecting elevated chip gross sales.

Along with hovering earnings, Nvidia’s free cash flow is up 430% within the final yr to greater than $27 billion, considerably greater than AMD’s $1 billion.

So, regardless of new GPU releases from its opponents, Nvidia’s head begin in AI doubtlessly pushed it additional forward with higher money reserves to proceed investing in its know-how and retain its market supremacy.

Nvidia has a robust place in AI that appears unlikely to dissipate anytime quickly. Its market cap surpassed $2 trillion this yr because of its huge success in AI. AMD’s market cap is considerably decrease at about $327 billion. Nevertheless, that might imply AMD has extra room to run over the long run as the corporate continues to be within the early levels of its AI journey.

Is AMD or Nvidia the higher AI inventory?

AI can doubtlessly increase numerous industries, from cloud computing to client merchandise, autonomous automobiles, video video games, and extra. With so many sectors prioritizing generative know-how, chip demand is barely prone to proceed rising for the foreseeable future.

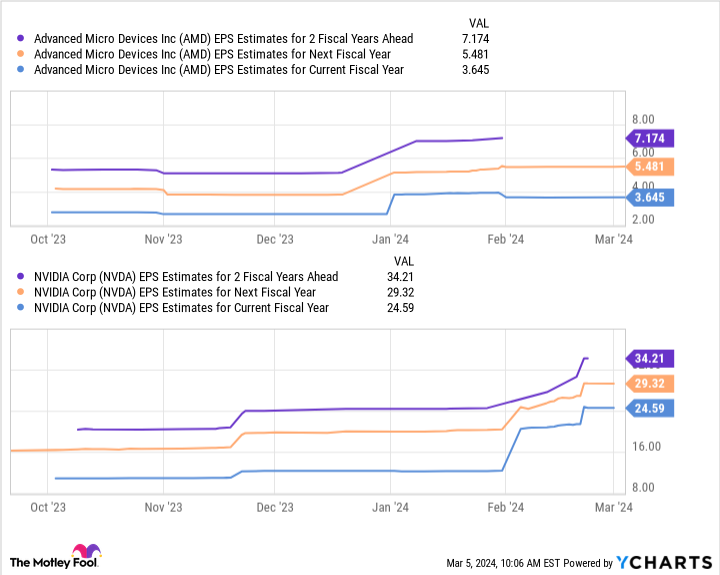

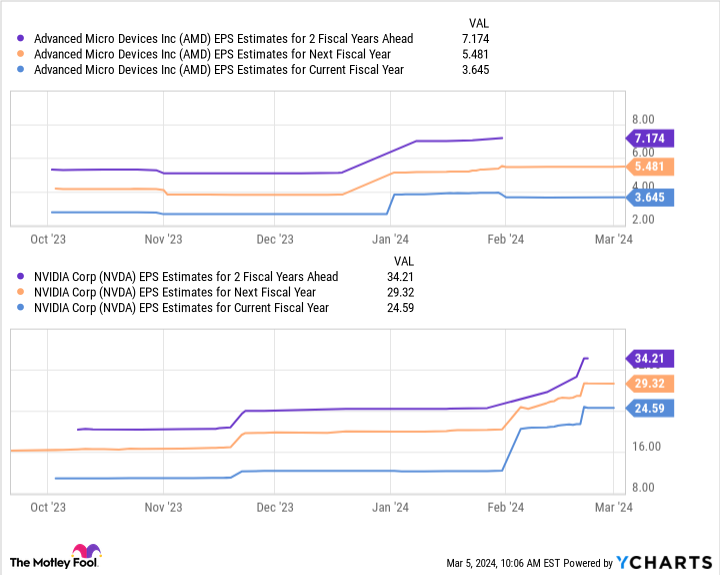

In consequence, AMD and Nvidia are two thrilling choices to spend money on AI. Nevertheless, earnings per share (EPS) estimates point out AMD may need extra development potential within the close to time period.

This chart reveals AMD’s earnings may hit simply over $7 per share within the subsequent two fiscal years, whereas Nvidia’s might attain $34 per share. On the floor, Nvidia seems to be just like the clear winner. Nevertheless, multiplying these figures by the businesses’ ahead price-to-earnings ratios (AMD’s 56 and Nvidia’s 35) yields inventory costs of $403 for AMD and $1,197 for Nvidia.

Contemplating their present positions, these projections would see AMD’s inventory rise 99% and Nvidia’s 41% by fiscal 2026.

Alongside heavy funding in AI and doubtlessly extra room to run, AMD is the higher AI inventory over Nvidia and a screaming purchase this month.

The place to speculate $1,000 proper now

When our analyst workforce has a inventory tip, it may possibly pay to pay attention. In spite of everything, the publication they’ve run for twenty years, Motley Idiot Inventory Advisor, has greater than tripled the market.*

They simply revealed what they imagine are the 10 best stocks for buyers to purchase proper now… and Superior Micro Units made the listing — however there are 9 different shares chances are you’ll be overlooking.

*Inventory Advisor returns as of March 8, 2024

Dani Cook has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units and Nvidia. The Motley Idiot has a disclosure policy.

Better AI Stock: AMD vs. Nvidia was initially revealed by The Motley Idiot