Backed by the overall crypto market beneficial properties and growing investor curiosity in meme cash launched on the Solana (SOL) blockchain, the community’s native token has registered stellar efficiency within the present rally.

Certainly, SOL buyers are anticipating the following value motion that would pave the way in which for a possible document excessive above the $200 mark, because the neighborhood stays tremendous bullish.

Notably, the expansion in SOL costs has coincided with a major on-chain motion of the token. Notably, data offered by Whale Alert on March 29 signifies that 1,757,028 SOL tokens price roughly $332 million have been moved between unknown wallets.

It’s price noting that the numerous switch of SOL tokens has the potential to impression the valuation of the token in both path. As an example, in circumstances the place there are giant actions of promoting, it will increase the provision, probably decreasing costs, whereas holding reduces the provision, probably elevating costs.

What subsequent for Solana?

When wanting on the subsequent Solana value, apart from the whale exercise, the token is influenced by a number of parts. At the moment, SOL is consolidating under the $200 mark, with a bit of analysts stating that the token can probably transfer in both path.

Notably, crypto buying and selling analyst Buying and selling Shot pointed out that SOL can probably retrace to $155 or hit a brand new document excessive of $310. His projection is predicated on technical analysis, the place he noticed that SOL was buying and selling inside a triangle sample within the one-day timeframe.

Within the March 29 evaluation, he identified that the one-day moving average (MA) of fifty has offered constant support since late September 2023, with solely a short break occurring for 4 days in late January 2024 in the course of the earlier related channel-up part.

“That Channel Up additionally shaped a Triangle half-way by and when the value broke to the upside, it peaked on its 1.5 Fibonacci extension. In consequence, we’ll purchase in case an identical bullish break-out takes place and goal $310. If the Triangle breaks to the draw back first although, we’ll quick and goal the 1D MA50 at $155,” he mentioned.

Within the meantime, Solana is prone to be swayed by actions associated to the collapsed FTX crypto exchange. Notably, the administration of the bankrupt buying and selling platform will promote its stability of 41 million in Solana to institutional buyers at round a $60 low cost. Certainly, SOL is prone to be swayed as soon as the tokens hit the market.

Solana outshines Ethereum

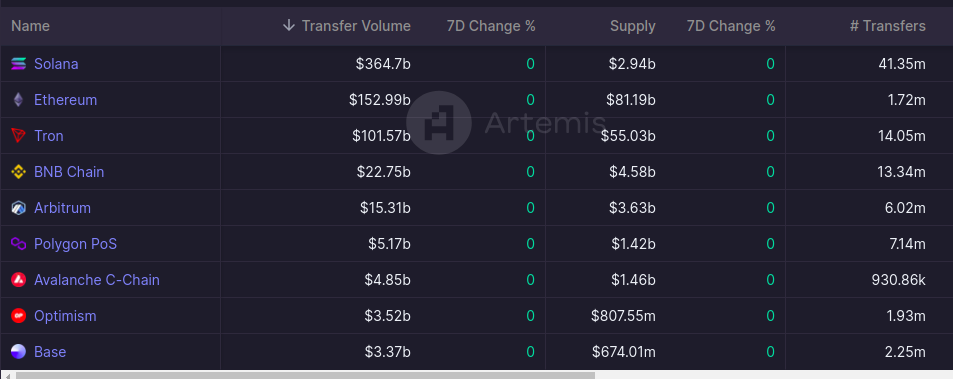

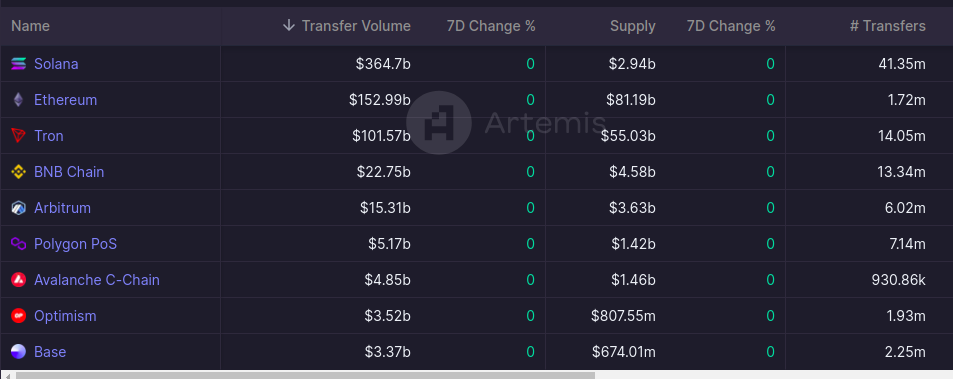

Moreover, on-chain metrics level to a bullish Solana value outlook. Particularly, data from the blockchain analytics platform Artemis signifies that as of March 30, Solana’s weekly switch quantity for stablecoins surged to $364.7 billion, surpassing Ethereum’s (ETH) reported quantity of $152.99 billion.

This metric bodes effectively with Solana’s aspiration to emerge as a potential competitor to Ethereum as a decentralized finance (DeFi) platform.

Elsewhere, it is going to even be attention-grabbing to observe how the upcoming Solana Saga smartphone will play out. The token’s rally was partly attributed to the demand for the primary model of the system, which has been touted as crypto-friendly.

SOL’s bearish fundamentals

Moreover, Solana faces a number of headwinds concerning its potential march to a brand new all-time excessive. As an example, the community has confronted perennial considerations about outages that may deter builders.

On the similar time, with the meme cash launched on the platform performing as key catalysts, there’s a name for warning, contemplating that such tokens usually haven’t any underlying fundamentals and are prone to see corrections.

In the meantime, by press time, Solana was buying and selling at $196 with every day beneficial properties of virtually 7%. On the weekly chart, SOL is up 12%.

Disclaimer: The content material on this website shouldn’t be thought-about funding recommendation. Investing is speculative. When investing, your capital is in danger.