Former Treasury Secretary Steve Mnuchin is making an enormous guess that regulators don’t need NYCB to turn out to be the following SVB.

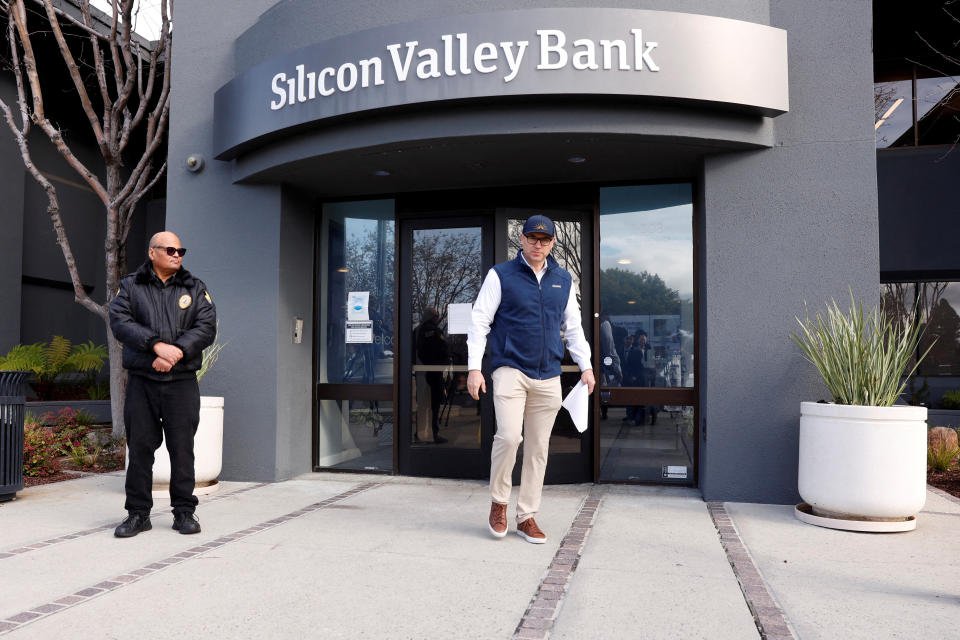

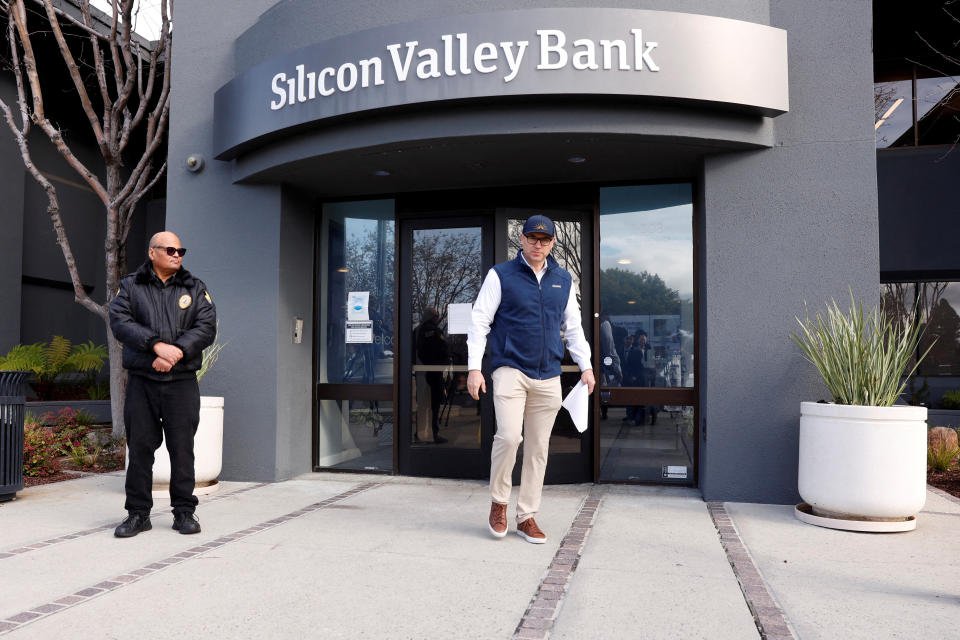

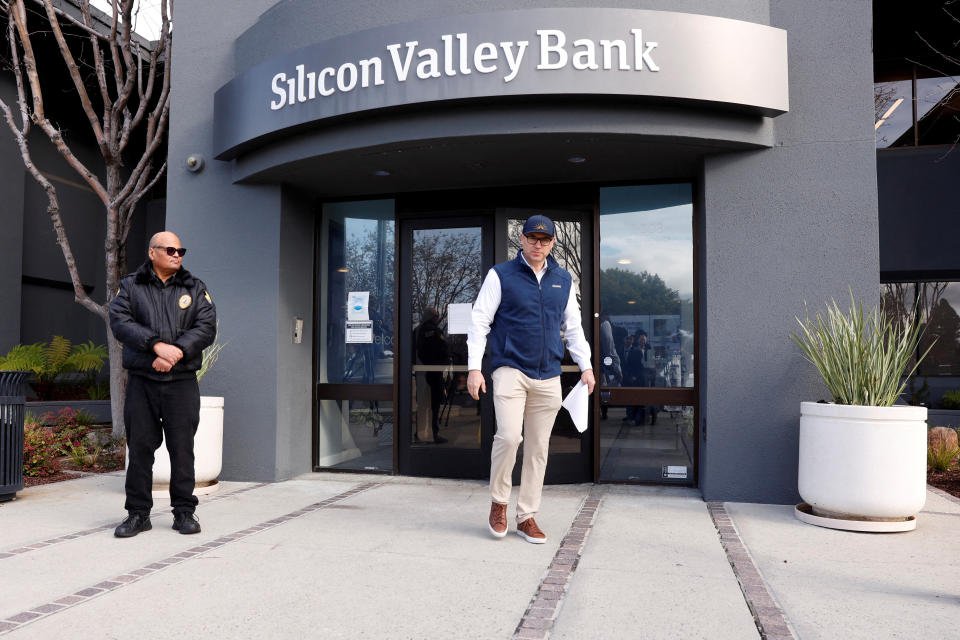

He and an investor group completed their $1 billion deal to inject new capital into troubled lender New York Group Bancorp (NYCB) simply days earlier than the one-year anniversary of the federal government seizure of California lender Silicon Valley Financial institution (SVB). That March 10 failure in 2023 triggered widespread panic within the banking system.

Mnuchin apparently tried to make sure this was OK with regulators. He told CNBC he had “in depth” conversations with the Federal Reserve and the Workplace of the Comptroller of the Foreign money, and so they supported the injection.

There’s a probably purpose why: What regulators discovered from the upheaval of a yr in the past is that they need to repair issues at particular person banks earlier than it’s too late — and definitely earlier than a shock seizure causes undue panic within the monetary markets.

“We weren’t fast sufficient, we weren’t efficient sufficient,” Fed Chair Jay Powell advised Senate lawmakers Thursday, referring to the Fed’s supervision of SVB. The lesson was that “earlier interventions and simpler ones” must occur going ahead.

Not solely is a non-public answer for a troubled lender normally preferable to a public one, it’s additionally cheaper for the broader banking system.

“From the FDIC’s standpoint, anytime you might have an open financial institution answer that does not contain the Deposit Insurance coverage Fund, that is factor,” Mitchell Glassman, an adviser with Secura/Issac, advised Yahoo Finance.

Nobody “desires to undertake that burden, if they will keep away from doing so,” added John Popeo, a monetary guide and former legal professional with the FDIC.

Large banks paid billions within the fourth quarter to cowl the losses absorbed by the Federal Deposit Insurance coverage Company from the failures of Silicon Valley Financial institution and New York lender Signature Financial institution, which was seized on March 13.

Banks will probably must pay billions extra nonetheless. The FDIC this week revised its complete loss determine from the March 2023 failures up by roughly $4 billion, to $20.4 billion.

The priority haunting banks in 2024 has to do with business actual property, and whether or not lenders have sufficient put aside to cope with the losses which can be anticipated from half-empty workplace buildings and multifamily condominium complexes now not price as a lot as they had been pre-pandemic.

Powell, throughout his testimony to lawmakers this previous week, mentioned the Fed is in touch with banks to ensure they’ve sufficient liquidity and capital to soak up any losses from business actual property exposures.

“We are attempting to remain forward of it on a bank-by-bank foundation and up to now we’ve been in a position to try this,” he mentioned.

“I do imagine it’s a manageable downside,” he added. “If that adjustments I’ll say so.”

FDIC Chair Martin Gruenberg advised reporters Thursday that business actual property stays a “draw back danger for the business, and it is definitely been a excessive precedence for the FDIC and the opposite banking companies by way of our supervisory work.”

The irony of NYCB’s predicament in 2024 is {that a} yr in the past it performed the function of rescuer, agreeing to soak up property from Signature that had been seized by regulators. That pushed it over $100 billion in property, which introduced heightened scrutiny from regulators.

NYCB has mentioned these tighter necessities are what led to the choice on Jan. 31 to slash its dividend and put aside extra for future mortgage losses — a disclosure that marked the start of a inventory slide that didn’t let up till Mnuchin introduced his rescue.

The inventory rose 6% the day the $1 billion infusion was introduced.

The brand new CEO of NYCB, former Comptroller of the Foreign money Joseph Otting, told analysts Thursday he desires the financial institution to have a extra numerous mortgage e book, with one-third in client, one-third in corporations, and one-third in actual property.

At present, greater than 44% of its loans are to multifamily properties, including many rent-regulated apartment complexes in New York City.

Attending to that higher steadiness might require extra personal options for NYCB. It “goes to be troublesome with out one other acquisition or potential divestitures of CRE loans,” Jonathan Winick, CEO of Chicago-based Clark Road Capital, advised Yahoo Finance.

When requested if the financial institution would not want to boost extra capital, Otting mentioned the financial institution and its board want “just a little little bit of time” to give you “the imaginative and prescient of the best way we see the way forward for the financial institution.”

He pledged to share it when NYCB reviews first quarter earnings.

“There’s heavy lifting forward and the form, timing and the chance of success of any potential turnaround stays an unknown,” Ebrahim Poonawala, an analyst protecting NYCB for Financial institution of America, mentioned Friday.

As a reminder, the inventory dropped once more on Friday by 7%, closing at $3.42 a share.

However Mnuchin and the opposite buyers are nonetheless up on their funding: They agreed to pay $2 a share.

David Hollerith is a senior reporter for Yahoo Finance protecting banking, crypto, and different areas in finance.

Click here for in-depth analysis of the latest stock market news and events moving stock prices.

Read the latest financial and business news from Yahoo Finance