[ad_1]

Whereas Nvidia‘s (NASDAQ: NVDA) AI-fueled rally is probably not over, it turns into more and more troublesome to justify shopping for the inventory because the GPU maker’s valuation soars. With a market capitalization of $2.2 trillion as of noon Wednesday, the inventory requires buyers to disregard the myriad threats that might unravel the corporate’s dominance of the AI chip market.

The most important benefit Nvidia has comes from software program. CUDA is Nvidia’s software program toolkit for creating purposes that may be accelerated by its GPUs. CUDA has been round for 16 years and has develop into the de facto commonplace. Because the AI increase obtained underway, the trail of least resistance was Nvidia GPUs and CUDA-powered software program.

Whereas there are options to CUDA, there is a large quantity of inertia holding Nvidia’s dominance intact. With out this software program benefit, competing AI chips from AMD, Intel, and others could be having a neater time successful market share.

Nvidia just lately up to date its end-user license settlement for CUDA to explicitly disallow translation layers that allow CUDA-based software program to run on non-Nvidia {hardware}. The corporate is clearly frightened about competitors chipping away at its dominant market place. The top of CUDA’s dominance could be a boon for any firm that buys AI accelerators, and it is more likely to occur ultimately as AI firms search options.

A low-risk option to wager on AI

Whereas Nvidia’s aggressive benefits will possible erode over time as competitors heats up, Worldwide Enterprise Machines (NYSE: IBM) is positioning itself to be the go-to platform for AI amongst giant enterprises and organizations. The corporate’s watsonx AI platform, which will get its identify from the Watson AI supercomputer that gained Jeopardy! in 2011, is geared toward the kind of prospects that may’t throw warning to the wind as they undertake AI know-how.

The watsonx platform allows enterprises to coach, validate, and deploy AI fashions whereas keeping track of compliance, threat administration, and governance points. Corporations that function in extremely regulated industries should comply with strict guidelines relating to their information, and no firm needs a customer-facing AI chatbot to go off the rails. IBM’s watsonx platform gives guardrails for enterprises deploying AI.

Past basic use circumstances, watsonx has some particular capabilities that may drive adoption. IBM’s mainframe programs, which have been on the coronary heart of some industries for many years, run billions of strains of delicate, mission-critical code written in an historic programming language known as COBOL. Because the variety of builders able to writing and sustaining COBOL code declines, IBM’s mainframe prospects are put in a bind.

That is the place the watsonx Code Assistant comes into play. One utility for this product is modernizing COBOL code by remodeling it into Java code. This course of should be executed with care as a result of a lot of this code is very delicate — suppose software program that processes transactions at main monetary establishments. This performance is not going to solely drive prospects to undertake the watsonx platform but additionally strengthen the mainframe enterprise by making it a lot simpler to modernize purposes.

Nonetheless a cut price inventory

IBM inventory has rallied over the previous yr, gaining about 50% in that point. Optimism concerning the firm’s AI prospects together with a string of strong outcomes are the possible culprits behind the surge.

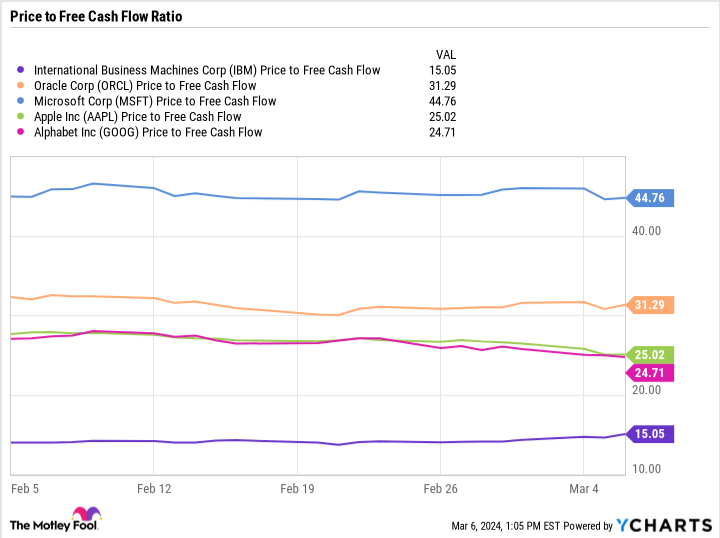

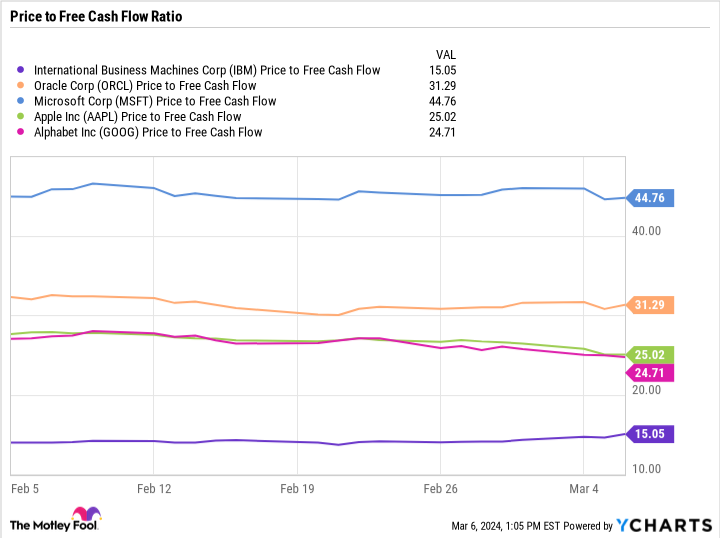

At the same time as IBM inventory closes in on its all-time excessive, the inventory stays an ideal worth for buyers. The corporate expects to generate free money circulate of about $12 billion this yr, which places the price-to-free money circulate ratio at 15. For comparability, different giant tech firms commerce at considerably greater multiples of free money circulate.

AI is only a piece of what IBM does, however it’s more likely to be a key development driver within the years forward. The inventory is not practically as low-cost because it as soon as was, however it’s nonetheless a beautiful funding for these seeking to faucet into the AI increase with out taking up extreme ranges of threat.

Do you have to make investments $1,000 in Worldwide Enterprise Machines proper now?

Before you purchase inventory in Worldwide Enterprise Machines, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Worldwide Enterprise Machines wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 8, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Timothy Green has positions in Worldwide Enterprise Machines. The Motley Idiot has positions in and recommends Alphabet, Apple, Microsoft, Nvidia, and Oracle. The Motley Idiot recommends Worldwide Enterprise Machines and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

Missed Out on Nvidia? This Enterprise AI Stock Is Still a Bargain. was initially printed by The Motley Idiot