[ad_1]

Shares of presidency IT safety contractor Palantir Applied sciences (NYSE:PLTR) loved a terrific month of February taking pictures up greater than 50% after reporting quarterly gross sales progress of 20%, and quarterly earnings progress of greater than 200%. Because of this speedy rise in share worth, nonetheless, the corporate’s inventory now sells for a nosebleed 270 instances trailing earnings – and even 77 instances the earnings it’s presupposed to earn subsequent 12 months.

Is that an excessive amount of to pay for Palantir, although? Though the inventory has its positives, in keeping with William Blair analyst Louie DiPalma, it’s truly an excessive amount of to pay – and that’s why DiPalma truly thinks you need to promote Palantir inventory regardless of its evident recognition.

Why does he suppose this?

Excellent news first. Keying off of reporting by Bloomberg Thursday night time, DiPalma notes that Palantir is closely concerned in a U.S. Pentagon “machine imaginative and prescient” challenge known as “Maven,” which goals to make use of synthetic intelligence algorithms to assist navy drones discover their targets. What’s extra, this so-called Maven Sensible System has progressed past concept, and is meant to be truly deployed at current within the Crimson Sea battle zone.

Though Palantir isn’t the one IT firm concerned in Maven, and its protection enterprise isn’t rising as rapidly as its rivals’, DiPalma believes that revenues from Maven will assist to present Palantir’s revenues a lift in Q1 2024. DiPalma’s objection is that that enhance gained’t be large enough to justify Palantir’s valuation after its current run-up.

Certainly, DiPalma even appears to argue that Palantir inventory was overvalued earlier than the inventory began operating away in February. In giving steering for 2024 revenues, you see, Palantir advised traders to anticipate numbers within the $2.65 billion to $2.67 billion vary. That sounds fairly good, implying that revenues will develop about 19% compared to 2023 ranges. The issue is that, earlier than this steering got here out, analysts had been considering Palantir inventory would extra doubtless generate revenues of $2.8 billion or extra… and valuing the inventory within the $6- to $8-a-share vary.

Let me repeat that: When traders thought Palantir would generate extra income than administration simply mentioned it will, they nonetheless valued the inventory at a share worth as a lot as 76% beneath the place the inventory now trades. Conversely, traders are actually paying 4 instances more cash for a corporation that simply mentioned it’s going to make much less income than it was presupposed to.

Does that make sense to you? As a result of it doesn’t to DiPalma.

Whereas it’s true that Palantir lastly turned worthwhile in 2023 (and that’s a great factor), the inventory’s $25-plus share worth, divided by the $0.09 per share it earned final 12 months, works out to a P/E ratio of 278. And even with earnings anticipated to develop 44% this 12 months (to $0.13 per share), and 31% the 12 months after that (to $0.17 per share)… effectively, that works out to ahead P/E ratios of 192 and 147, respectively, for the following two years’ earnings.

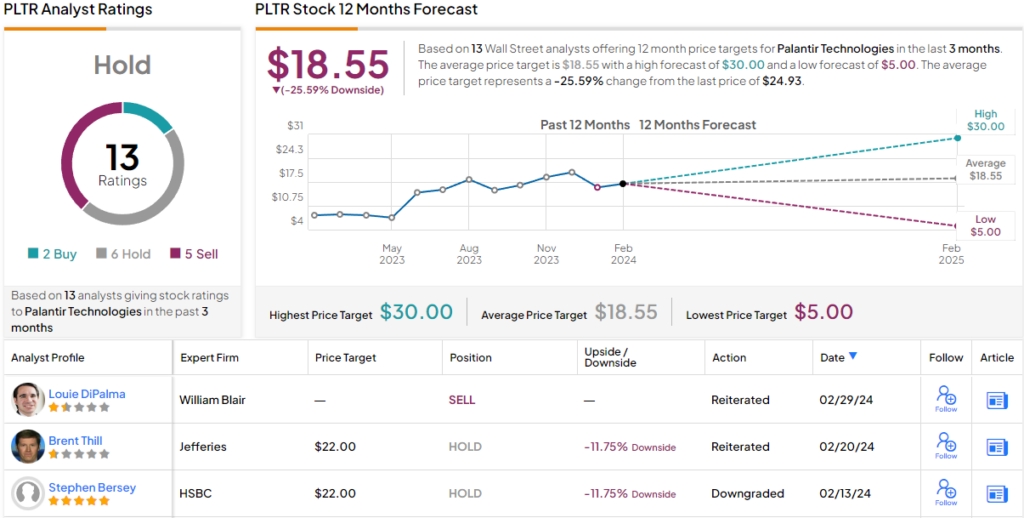

General, the Avenue is lukewarm at current relating to Palantir shares’ prospects. Primarily based on 13 analysts tracked by TipRanks within the final 3 months, 6 fee PLTR as a Maintain (i.e. impartial), 5 recommend Promote, and solely 2 suggest Purchase. The 12-month common worth goal stands at $18.55, marking ~26% draw back from the place the inventory is at present buying and selling. (See PLTR stock forecast)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Best Stocks to Buy, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is vitally essential to do your personal evaluation earlier than making any funding.