[ad_1]

Fox Information contributor Liz Peek, Nationwide Evaluation reporter Caroline Downey and writer Batya Ungar-Sargon react to President Biden claiming local weather change is worse than nuclear bombs on ‘Kudlow.’

Investment management company BlackRock admitted in its annual submitting to the Securities and Exchanges Fee that its CEO Larry Fink’s environmental, social, and governance insurance policies (ESG) advocacy may hurt its “fame” and damage its backside line.

“BlackRock’s enterprise, scale and investments topic it to vital media protection and rising consideration from a broad vary of stakeholders,” the submitting submitted late final month mentioned. “This heightened scrutiny has resulted in adverse publicity and opposed actions for BlackRock and will proceed to take action sooner or later.”

It continued, “Any perceived or precise motion or lack thereof, or perceived lack of transparency, by BlackRock on issues topic to scrutiny, reminiscent of ESG, could also be seen in a different way by numerous stakeholders and adversely affect BlackRock’s fame and enterprise, together with by way of redemptions or terminations by purchasers, and authorized and governmental motion and scrutiny.”

Fink, who has been an advocate for investing in clear power, has confronted scrutiny by conservatives, together with a variety of Republican attorneys common.

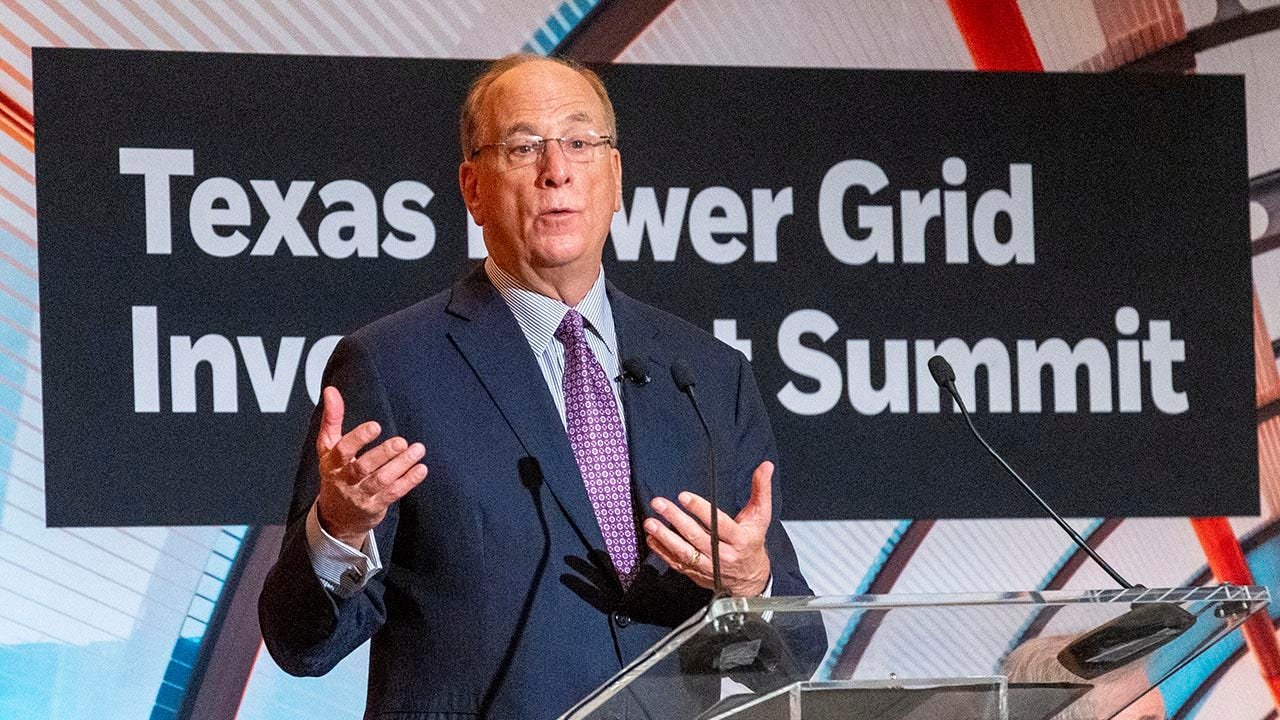

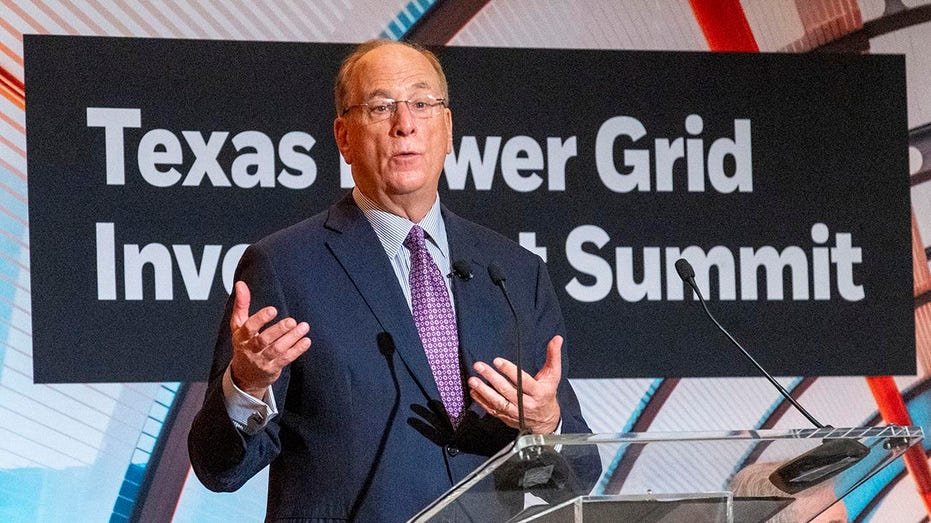

Larry Fink met with Republicans at a Houston summit final month after being blacklisted from the state over BlackRock’s ESG advocacy. (Kirk Sides/Houston Chronicle by way of Getty Photographs / Getty Photographs)

“The overlapping internet of non-public and enterprise relationships between main mutual fund administrators and BlackRock elevate crimson flags about potential conflicts of curiosity, and name even additional into query the misguided funding methods executed within the identify of ESG,” Virginia’s Legal professional Basic Miyares mentioned final 12 months in a launch asserting Virginia was becoming a member of a coalition of states demanding solutions from BlackRock.

Tennessee’s Legal professional Basic Skrmetti mentioned final 12 months, whereas asserting a lawsuit towards BlackRock over ESG, “[s]ome public statements present an organization that focuses completely on return on funding, others present an organization that offers particular consideration to environmental components. Finally, I wish to make sure that firms, regardless of their measurement, deal with Tennessee customers pretty and truthfully.”

BlackRock mentioned it rejects the lawsuit’s claims.

BLACKROCK, STATE STREET FACE SUBPOENAS IN HOUSE ESG PROBE

And final month, Texas blacklisted the corporate over its ESG insurance policies, prompting Fink to succeed in out to State Lieutenant Governor Dan Patrick and different Republican officers at an power funding summit in Houston.

BlackRock has about $10 trillion in property of which ESG accounts for round $700 billion, in line with the New York Post.

As ESG turns into extra controversial, it has affected different corporations too.

Bank of America appeared to renege on its 2021 pledge to not fund new coal tasks, saying in its finish of 12 months “Environmental and Social Danger Coverage Framework” submitting in December, new coal mines and vegetation, or Arctic oil drilling, such tasks will now face “enhanced due diligence.”

Some states, like New Hampshire, Texas and West Virginia, have handed legal guidelines to forestall banks from refusing to finance coal tasks, and have even sought to criminalize what is named, “environmental, social and governance” ideas inside corporations, in line with The New York Occasions.

The conservative backlash to environmental issues in enterprise has led different corporations to drag again from sure eco-friendly initiatives.

Earlier this 12 months, a coalition of 12 Republican state agriculture commissioners wrote a letter to 6 massive U.S. banks, together with Financial institution of America, over their net-zero ambitions, opening a brand new entrance within the pushback towards what they name “woke investing,” a combat that has primarily been spearheaded by state attorneys general and monetary officers.

All six banks are members of the Web-Zero Banking Alliance (NZBA).

CLICK HERE TO READ MORE ON FOX BUSINESS

Fox Enterprise has reached out to BlackRock for remark.