[ad_1]

-

Income Progress: This fall income surged by 80% to $17.1 million.

-

Adjusted EBITDA: Improved by 80% year-over-year in This fall.

-

Bookings Backlog: Mixed cumulative subscriptions & bookings backlog reached $661 million, doubling year-over-year.

-

Internet Loss: Decreased by 42% to $18.003 million in This fall and by 24% to $88.937 million for the total 12 months.

-

Liquidity: Complete money stability exceeded $200 million.

-

Outlook: 2024 income projected between $63 to $77 million, with a 2025 goal exceeding $100 million.

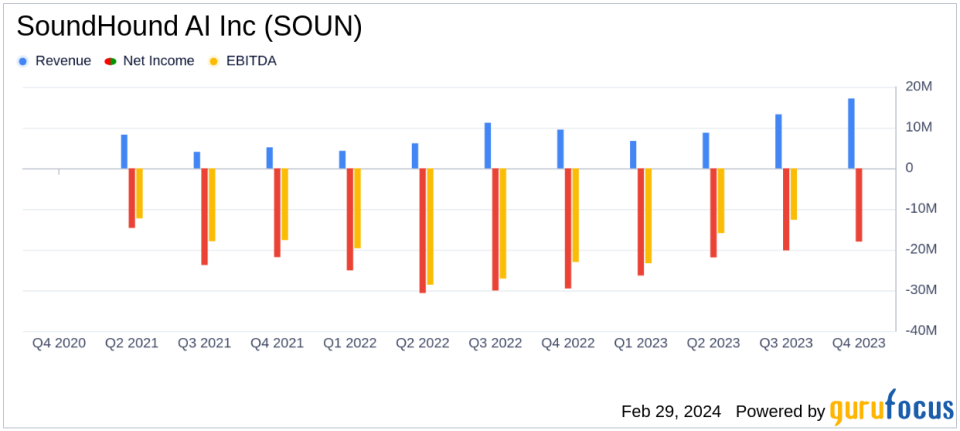

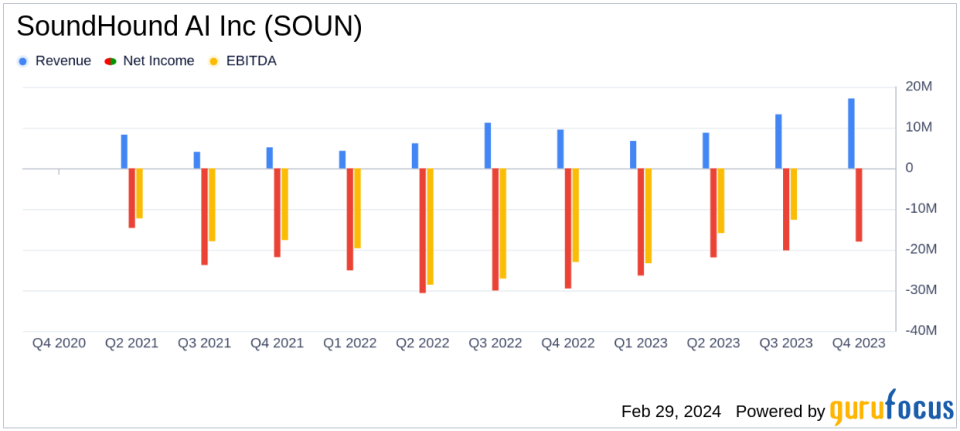

On February 29, 2024, SoundHound AI Inc (NASDAQ:SOUN) launched its 8-K filing, asserting a document quarter with an 80% improve in This fall income to $17.1 million and a big enchancment in adjusted EBITDA by 80% year-over-year. The corporate, a pioneer in conversational intelligence, has demonstrated sturdy monetary development and operational achievements, signaling a robust market place within the voice AI trade.

SoundHound AI Inc is famend for its impartial Voice AI platform, which empowers companies throughout varied sectors to offer superior conversational experiences. The corporate’s integration of latest generative AI capabilities and the acquisition of SYNQ3, which positions SoundHound as the biggest voice AI supplier for eating places, have been pivotal in driving client engagement and increasing market penetration.

Monetary Efficiency and Challenges

Regardless of the spectacular income development, SoundHound AI Inc confronted challenges, as mirrored in its web loss figures. The This fall web loss decreased by 42% to $18.003 million, and the full-year web loss noticed a 24% discount to $88.937 million. These losses spotlight the corporate’s ongoing investments in analysis and growth, in addition to gross sales and advertising and marketing efforts to seize a bigger share of the quickly evolving AI market.

Working bills for This fall had been lowered by 23% to $29.540 million, with vital cuts in gross sales and advertising and marketing (-34%) and analysis and growth (-41%). This strategic discount in bills, alongside income development, contributed to the improved backside line.

SoundHound AI Inc’s monetary achievements, notably the doubling of its bookings backlog to $661 million, underscore the corporate’s potential for sustained income development and market growth. This backlog, mixed with a robust liquidity positionwith a complete money stability exceeding $200 millionpositions the corporate to capitalize on the growing demand for AI options.

Key Monetary Metrics

Essential metrics from the monetary statements embrace:

– Income: This fall noticed a leap to $17.147 million, a big improve from the earlier 12 months’s $9.501 million.

– Working Bills: Complete working bills for the 12 months had been lowered by 16% to $114.481 million.

– Internet Loss Per Share: Decreased from $0.15 in This fall of the earlier 12 months to $0.07 within the present 12 months.

– Adjusted EBITDA: Improved to $(3.676 million) in This fall, a considerable improve from $(18.821 million) within the prior 12 months.

These metrics are essential as they supply insights into the corporate’s operational effectivity, price administration, and total monetary well being.

Wanting Forward

Wanting ahead, SoundHound AI Inc anticipates continued development, projecting full-year 2024 income to be within the vary of $63 to $77 million, with a midpoint goal of $70 million. The corporate additionally units an formidable 2025 outlook, anticipating to speed up development with income exceeding $100 million and reaching optimistic adjusted EBITDA.

CEO Keyvan Mohajer expressed confidence within the firm’s trajectory, stating,

Our tempo and agility amid this AI revolution has put us forward of the sphere relating to delivering actual industrial worth.”

CFO Nitesh Sharan additionally emphasised the corporate’s robust end to the 12 months and its readiness to fulfill the surging buyer demand for AI options.

For a extra detailed evaluation and extra info, buyers and stakeholders are inspired to evaluate SoundHound AI Inc’s SEC filings, which shall be accessible on the corporate’s web site and included within the upcoming 10-Ok submitting.

Traders and media can entry extra particulars by the contact info supplied, with Scott Smith dealing with investor relations and Fiona McEvoy managing media inquiries.

Discover the whole 8-Ok earnings launch (here) from SoundHound AI Inc for additional particulars.

This text first appeared on GuruFocus.