[ad_1]

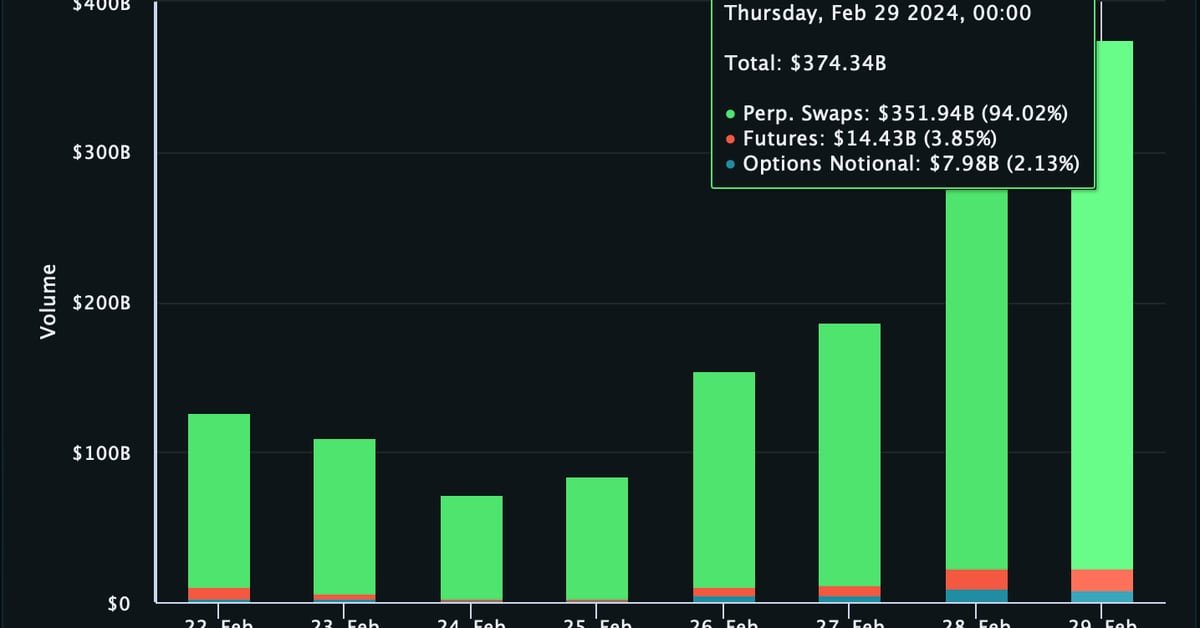

The bitcoin bull is back, and so is worth volatility. BTC traded 6.8% greater at $62,992 at press time, having printed highs close to $64,000 on Wednesday. The value has gained 21% this week alone. The CoinDesk 20 Index, a broader market gauge, traded 7.5% greater at $2,326. The cryptocurrency’s 30-day realized volatility, or the usual deviation of the final 30 days’ each day share worth change, has surged to an annualized 46% from 30% in per week. Exercise within the crypto derivatives market has picked up. In response to Swiss-based information tracked platform Laevitas, $374 billion price of crypto futures, perpetual futures and choices contracts have modified palms previously 24 hours. That is the most important single-day tally since November 2021. Renewed demand for leveraged merchandise, which amplify earnings and losses, suggests a rise in threat urge for food and the potential for sudden liquidations-induced price turbulence.

Bitcoin miners are selling more of their cash and working down their inventories in a rising market. Knowledge tracked by Glassnode reveals the estimated variety of BTC held in wallets tied to miners has dropped by 8,426 BTC ($530 million) for the reason that begin of the 12 months to 1,812,482 BTC. The decline started within the second half of October when miners held over 1.83 million BTC. The approaching halving of miners’ rewards and the continued dry season in China have catalyzed the gross sales, in response to analysts at FRNT Monetary.

Morgan Stanley is deciding whether or not to supply spot bitcoin ETFs to clients of its giant brokerage platform, in response to two folks with data of the matter. The U.S. Securities and Alternate Fee greenlighted 11 spot bitcoin ETFs on Jan. 10. Since then, billions of {dollars} have poured into these merchandise, identified to carefully observe bitcoin’s worth and permitting traders to take publicity to the cryptocurrency with out proudly owning it. Liquidity floodgates, nevertheless, would open as soon as massive registered funding adviser (RIA) networks and broker-dealer platforms like Merrill Lynch, Morgan Stanley, Wells Fargo and others supply ETFs. Morgan Stanley, a pacesetter within the different investments and personal market area, has over $150 billion in belongings underneath administration and was the primary main U.S. financial institution to supply its rich shoppers entry to bitcoin funds in 2021.