[ad_1]

(Bloomberg) — Equities in Asia rose with US inventory futures forward of the Federal Reserve’s key inflation metric that can assist establish the trail ahead for rates of interest. Bitcoin surged previous $61,000.

Most Learn from Bloomberg

Korean and Indian shares fell, whereas Chinese language equities rebounded after Wednesday’s selloff. The yen climbed probably the most in additional than per week towards the greenback after Financial institution of Japan Board Member Hajime Takata signaled that the case for ending the unfavourable rate of interest coverage is gaining momentum. US fairness futures reversed an earlier drop after in a single day losses for the S&P 500 and Nasdaq 100.

Chinese language equities have rebounded sharply this month and are set for his or her greatest outperformance versus international shares since July after authorities took a slew of measures to bolster sentiment. Traders are waiting for subsequent week’s assembly of the Nationwide Folks’s Congress to ship extra help measures.

“The momentum could also be sustained towards the graduation of the NPC” on March 5, with most concentrate on ministerial feedback on capital market reform and industrial insurance policies, stated Redmond Wong, strategist at Saxo Capital Markets. However “elevated costs can set the stage for disappointment,” he stated.

Bitcoin prolonged positive aspects after surging above $60,000 for the primary time in additional than two years Wednesday, reflecting new demand from alternate traded funds. The foreign money virtually touched $64,000. The 2021 report excessive is slightly below $69,000.

Different notable strikes in Asian shares included a soar for Japanese lender Aozora Financial institution Ltd. after a fund linked to activist investor Yoshiko Murakami reported a shareholding. Alibaba shares dropped in Hong Kong after the corporate rolled out its second main price cuts for cloud companies in years.

Declines for US shares in a single day got here as information confirmed sturdy shopper spending regardless of a small revision to US gross home product development within the fourth quarter of 2023. The report comes forward of the Fed’s favored inflation gauge due Thursday and was broadly supportive of the warning voiced by Fed officers in current weeks.

Treasuries had been regular in Asia after a rally Wednesday noticed the 10-year yield falling 4 foundation factors and the policy-sensitive two-year slipping six foundation factors. Australian yields echoed the transfer in early Asian buying and selling whereas New Zealand yields had been largely unchanged.

Yen Climbs

A gauge of greenback was barely weak towards main currencies after rising on Wednesday. The yen strengthened as excessive as 149.70 versus the greenback as buyers positioned a probable narrowing within the rate of interest hole between Japan and the US.

“We anticipate the BOJ to reap the benefits of this reflationary setting to exit unfavourable charges, however the coverage stance will stay very accommodative by means of 2025,” Jessica Hinds, director at Fitch Scores stated in a be aware.

In Asia, financial experiences due Thursday embody fourth-quarter GDP information for India, the present account steadiness in Thailand, and inflation information for Sri Lanka and Vietnam.

New York Fed President John Williams stated Wednesday the central financial institution has “a methods to go,” in its battle towards inflation and Atlanta Fed chief Raphael Bostic urged persistence in regard to coverage tweaks. Total, current feedback from Fed officers underscore the significance of knowledge in guiding coverage strikes.

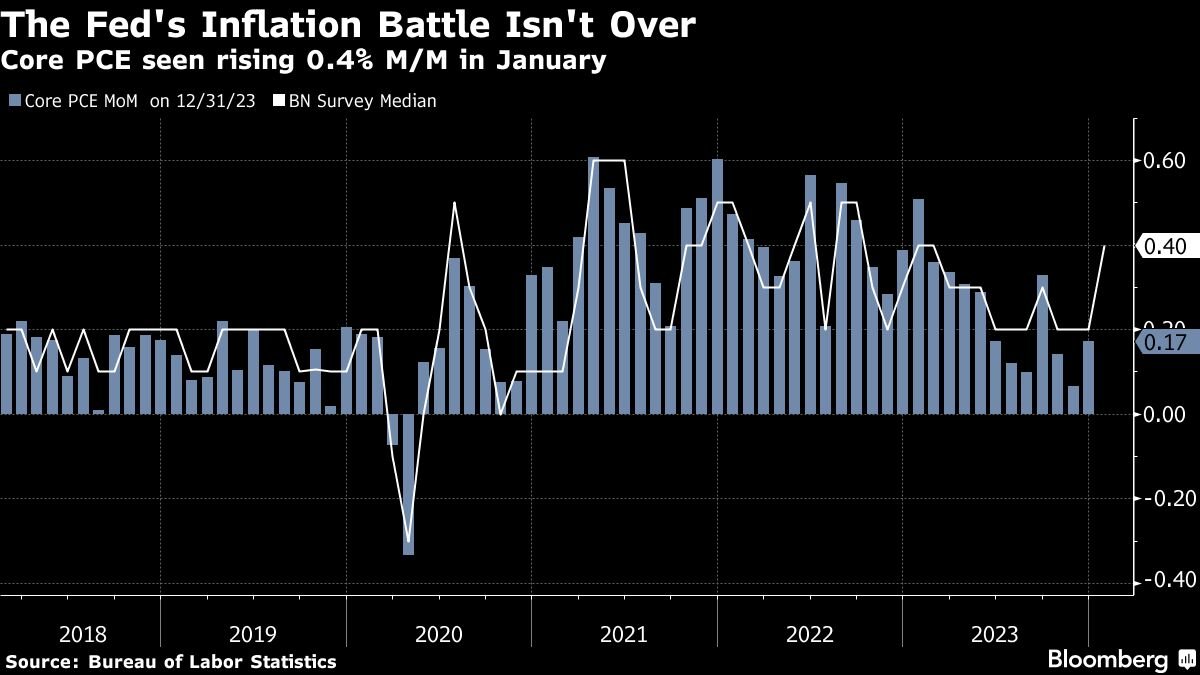

Following a soar in each the buyer and the producer worth indexes, Thursday’s core private consumption expenditures gauge will possible spotlight the bumpy path the central financial institution faces in reaching its 2% goal. The PCE is seen validating current commentary from officers exhibiting no rush to ease financial coverage.

“The current information is ‘noise’ and must be ignored exterior of its affect for very short-term market actions,” stated Chris Zaccarelli, chief funding officer for Unbiased Advisor Alliance. “We’re extra within the PCE information.”

Merchants are at the moment pricing round 80 foundation factors of easing by year-end — virtually in keeping with what officers in December indicated because the likeliest consequence. That may equate to 3 cuts in 2024 — because the Fed strikes have traditionally been increments of 25 foundation factors. To place issues in perspective, swaps had been projecting virtually 150 foundation factors of cuts this 12 months in the beginning of February.

Elsewhere, SQM, the world’s second-largest lithium producer, reported a 82% drop in quarterly earnings amid international glut for battery materials that the corporate expects will maintain costs subdued this 12 months.

Key Occasions This Week:

-

Germany CPI, unemployment, Thursday

-

US shopper earnings, PCE deflator, preliminary jobless claims, Thursday

-

Fed’s Austan Goolsbee, Raphael Bostic and Loretta Mester converse, Thursday

-

China official PMI, Caixin manufacturing PMI, Friday

-

Eurozone S&P World Manufacturing PMI, CPI, unemployment, Friday

-

BOE chief economist Huw Capsule speaks, Friday

-

US building spending, ISM Manufacturing, College of Michigan shopper sentiment, Friday

-

Fed’s Raphael Bostic and Mary Daly converse, Friday

A few of the foremost strikes in markets:

Shares

-

S&P 500 futures had been little modified as of two:17 p.m. Tokyo time

-

Nasdaq 100 futures was up 0.1%

-

Japan’s Topix was little modified

-

Australia’s S&P/ASX 200 rose 0.5%

-

Hong Kong’s Dangle Seng rose 0.2%

-

The Shanghai Composite rose 0.9%

-

Euro Stoxx 50 futures rose 0.1%

Currencies

-

The Bloomberg Greenback Spot Index fell 0.1%

-

The euro was little modified at $1.0833

-

The Japanese yen rose 0.6% to 149.84 per greenback

-

The offshore yuan was little modified at 7.2097 per greenback

Cryptocurrencies

-

Bitcoin rose 2.3% to $61,966.46

-

Ether rose 3.4% to $3,436.11

Bonds

Commodities

This story was produced with the help of Bloomberg Automation.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.